11 8 Divided By 4 - Organizing your daily jobs ends up being uncomplicated with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates use a hassle-free method to remain on top of your obligations. Developed for versatility, printable schedules are available in various formats, consisting of everyday, weekly, and monthly layouts. You can quickly personalize them to suit your requirements, guaranteeing your performance skyrockets while keeping everything in order. Most importantly, they're free and available, making it simple to plan ahead without breaking the bank.

From managing consultations to tracking objectives, 11 8 Divided By 4 are a lifesaver for anyone juggling multiple priorities. They are ideal for trainees managing coursework, specialists collaborating conferences, or households stabilizing busy routines. Download, print, and begin planning immediately! With a wide range of designs readily available online, you'll discover the perfect template to match your style and organizational needs.

11 8 Divided By 4

11 8 Divided By 4

I loved TheRat s original Dragon Thing but wanted to be able to really print it in high quality while putting both Meshmixer s Explore our meticulously crafted dragon 3D print files, each one optimized for seamless printing and stunning results. From fierce and majestic dragons to ...

WATCH ME 3D Print this Articulated Dragon YouTube

10

11 8 Divided By 4Check out our 3d printed dragon selection for the very best in unique or custom, handmade pieces from our stress balls & desk toys shops. Here is our selection of the best dragon STL files all these beautiful creatures are from the 3D file library Cults and are perfectly 3D printable

8219 Dragon 3D print models, available for download in STL, OBJ and other file formats, ready for printing with FDM, SLS and other 3D printers. 100 Divided By 86 What Is 8 Divided By 56

Dragon 3D Print STL Files

15 Divided By 23

12 inch 3D Printed Dragon Fidget Toy Full Articulated Dragon Crystal Dragon Home Office Decor Executive Desk Toys Fidget Toys for ADHD Color 1 4 44 4 out 10 Divided By 1 2

10000 dragon printable 3D Models Every Day new 3D Models from all over the World Click to find the best Results for dragon Models for your 3D Printer 10 Divided By 1 2 4 6 Divided By 1 2

15 Divided By 23

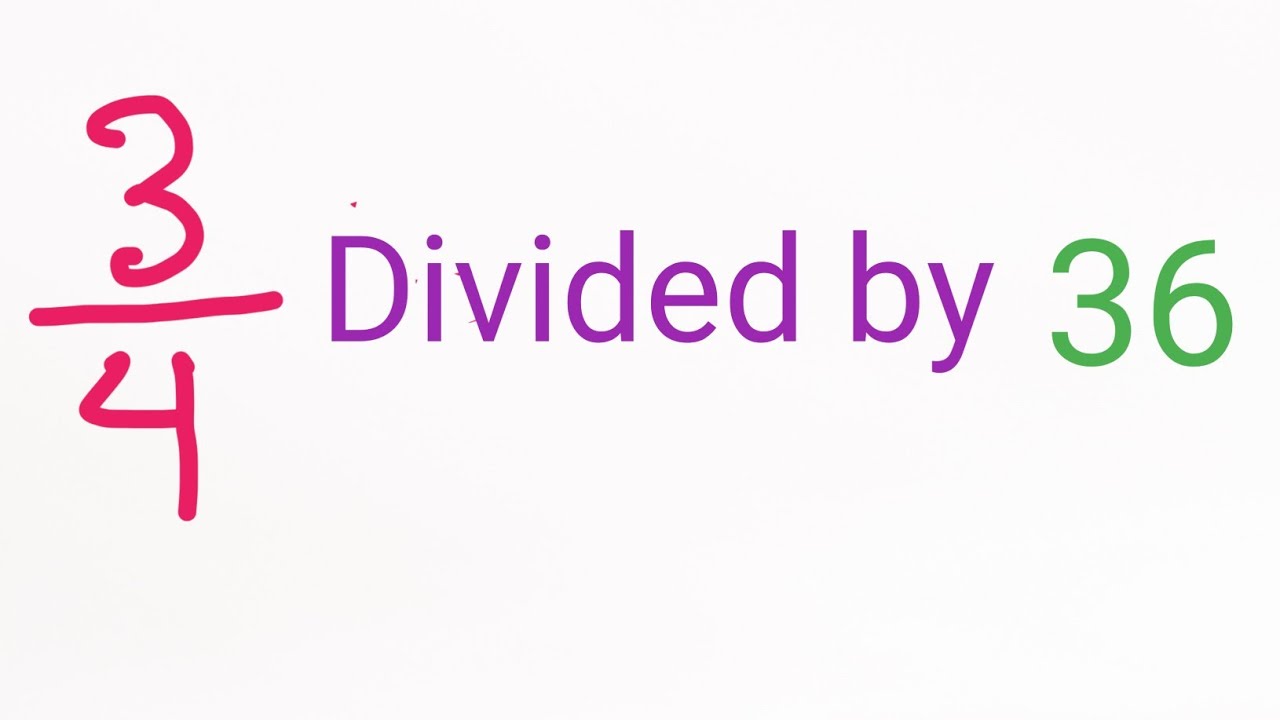

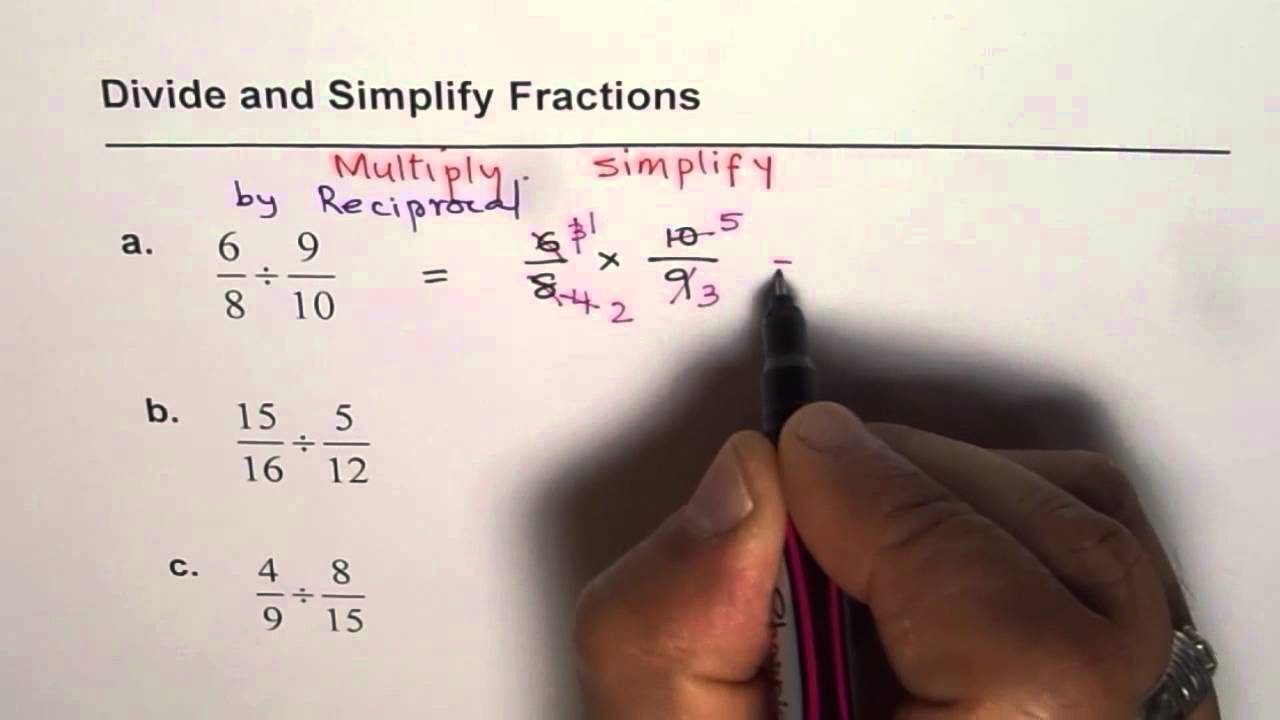

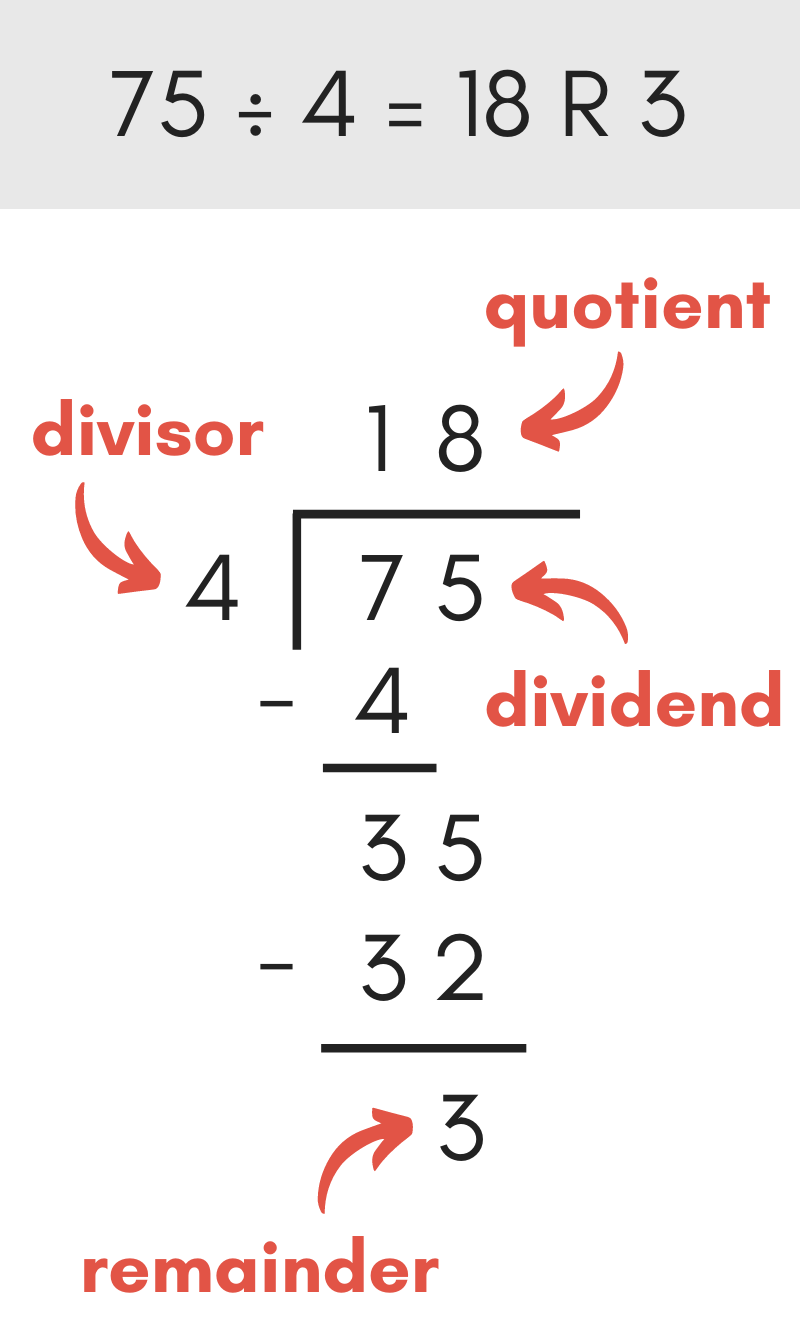

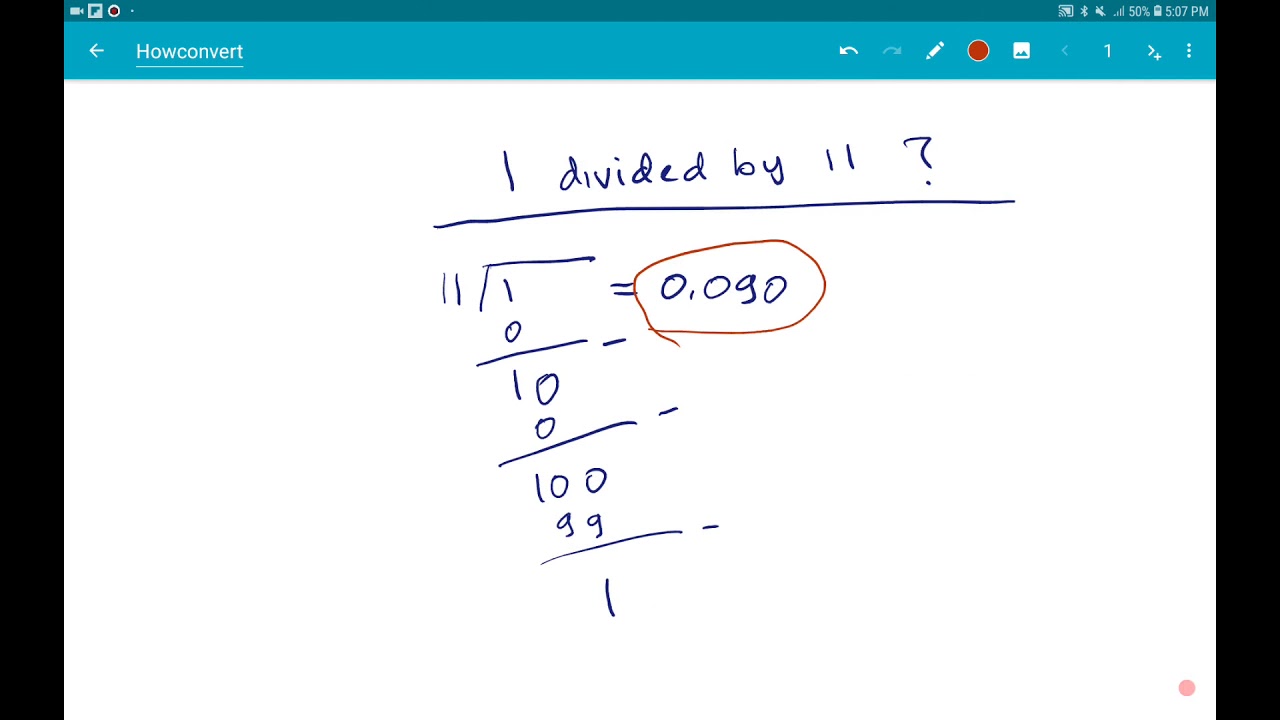

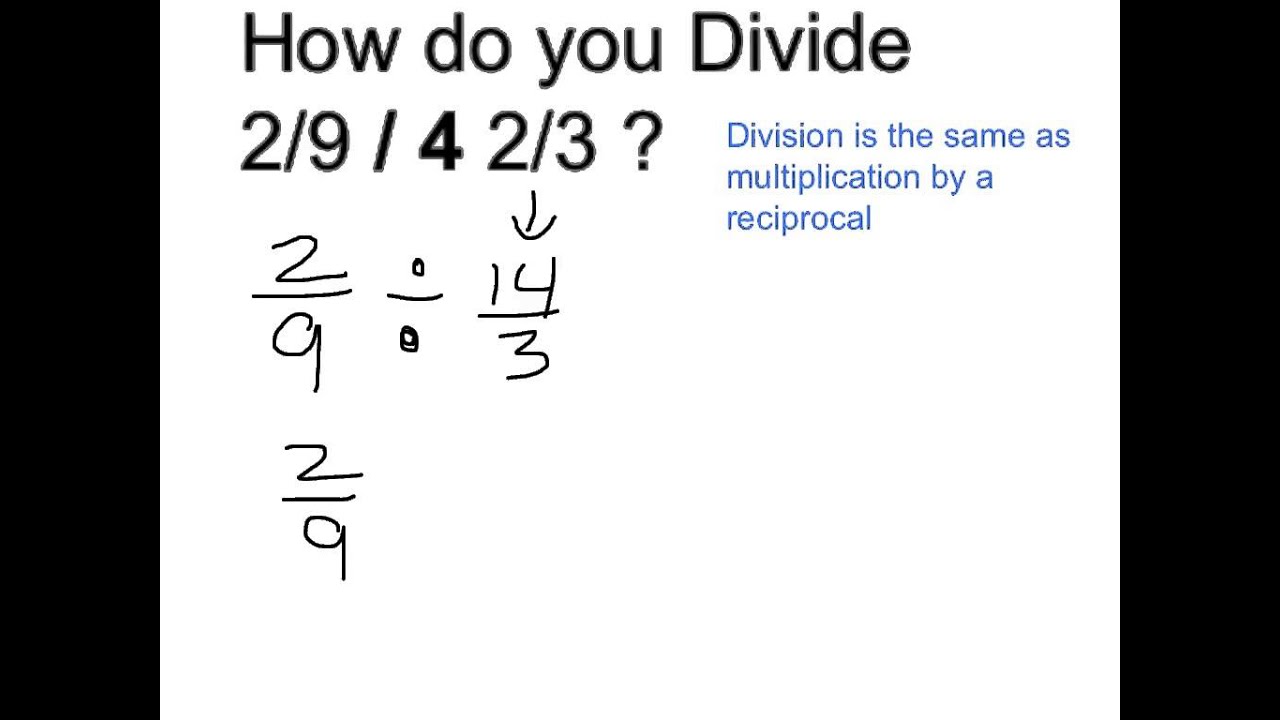

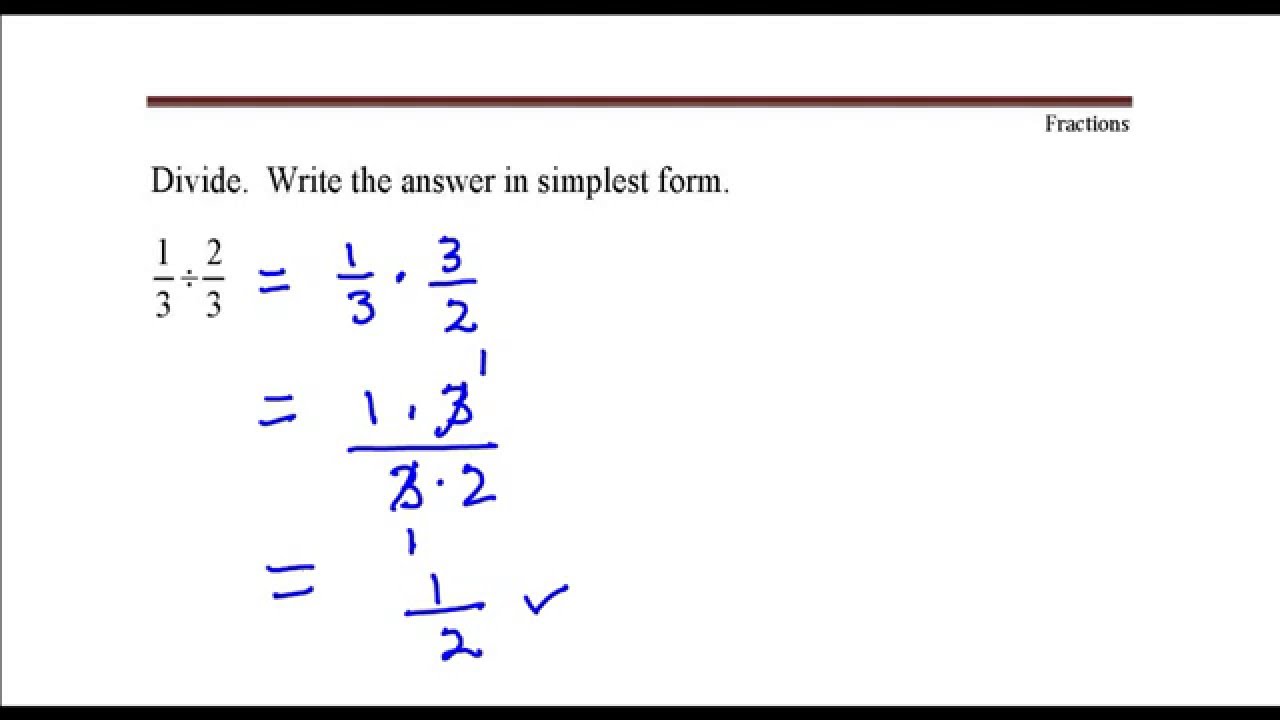

Solving Division

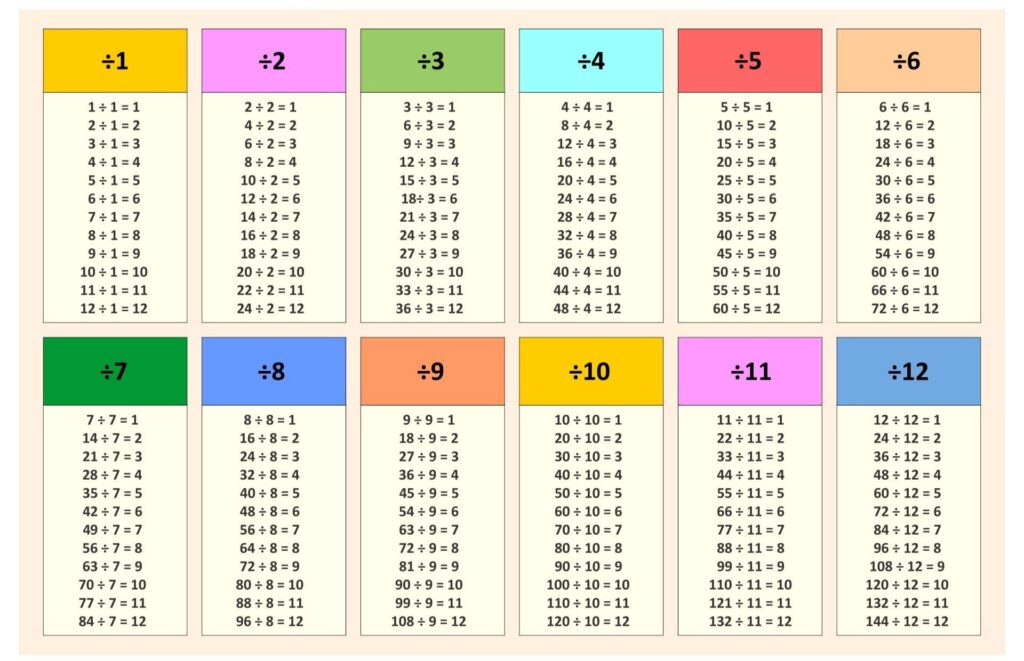

Three Division Tables

Two Division Tables

Division Charts Printable

Division Chart Printable

10 Divided By 17

10 Divided By 1 2

6 Divided By 100

10 Divided By 1 2