15 Divided By 4 1 6 - Organizing your daily jobs becomes simple and easy with free printable schedules! Whether you require a planner for work, school, or personal activities, these templates offer a practical method to stay on top of your responsibilities. Designed for flexibility, printable schedules are readily available in numerous formats, including daily, weekly, and monthly designs. You can easily customize them to fit your requirements, guaranteeing your productivity skyrockets while keeping everything in order. Most importantly, they're free and accessible, making it simple to prepare ahead without breaking the bank.

From handling consultations to tracking objectives, 15 Divided By 4 1 6 are a lifesaver for anybody balancing multiple priorities. They are perfect for trainees managing coursework, specialists coordinating meetings, or families stabilizing hectic routines. Download, print, and begin preparing right away! With a wide range of styles available online, you'll discover the best template to match your style and organizational requirements.

15 Divided By 4 1 6

15 Divided By 4 1 6

Customize bottle labels for your wine water beer and other craft beverages Print in waterproof and oil resistant materials Textured paper for wine and Shop blank or custom printed bottle labels in any size or shape. Hundreds of configurations and label materials to choose from. Order today!

Blank Bottle Labels SheetLabels

28 Divide By 30

15 Divided By 4 1 6Effortlessly create labels for anything and everything with our gallery of ready-made, printable product label templates. Print bottle labels for your products in waterproof and refrigerator safe material Design in custom sizes shapes and materials to fit your needs

Download free templates for large water bottle from Word, Canva, Adobe, Apple Pages and more. Find out which size you need for your containers. What Is 5 Divided By 3 7 What Is 1 Divided By 32

Bottle Labels Blank or Custom Printed OnlineLabels

28 Divide By 30

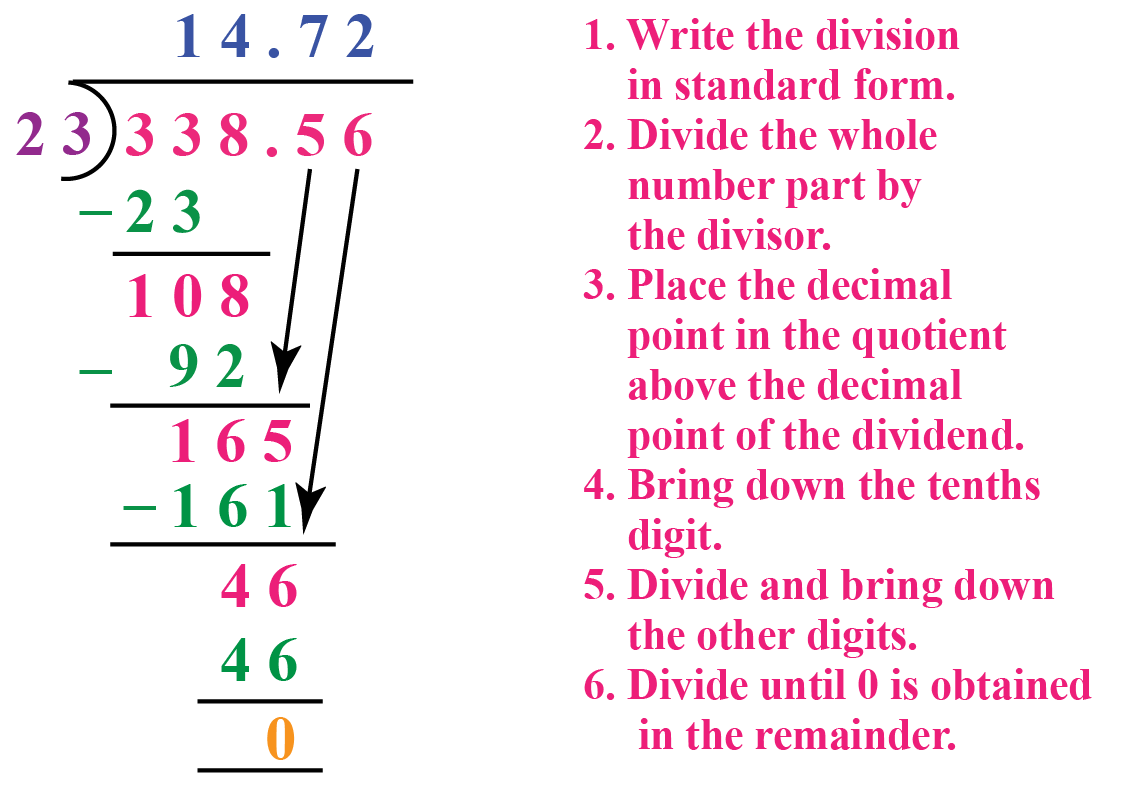

Browse our selection of square round and oval bottle label options on sheets rolls or cut to size finishing options Blank or printed labels for all your Long Division Decimals And Remainders

Order blank or custom bottle labels online in your shape size Get custom sizes at no extra cost From waterproof films to luxurious metallics 20 Divided By 5 5 8 What Is 3 Divided By 1 8

500 Divided By 15

28 Divide By 30

8 9 Divided By 8

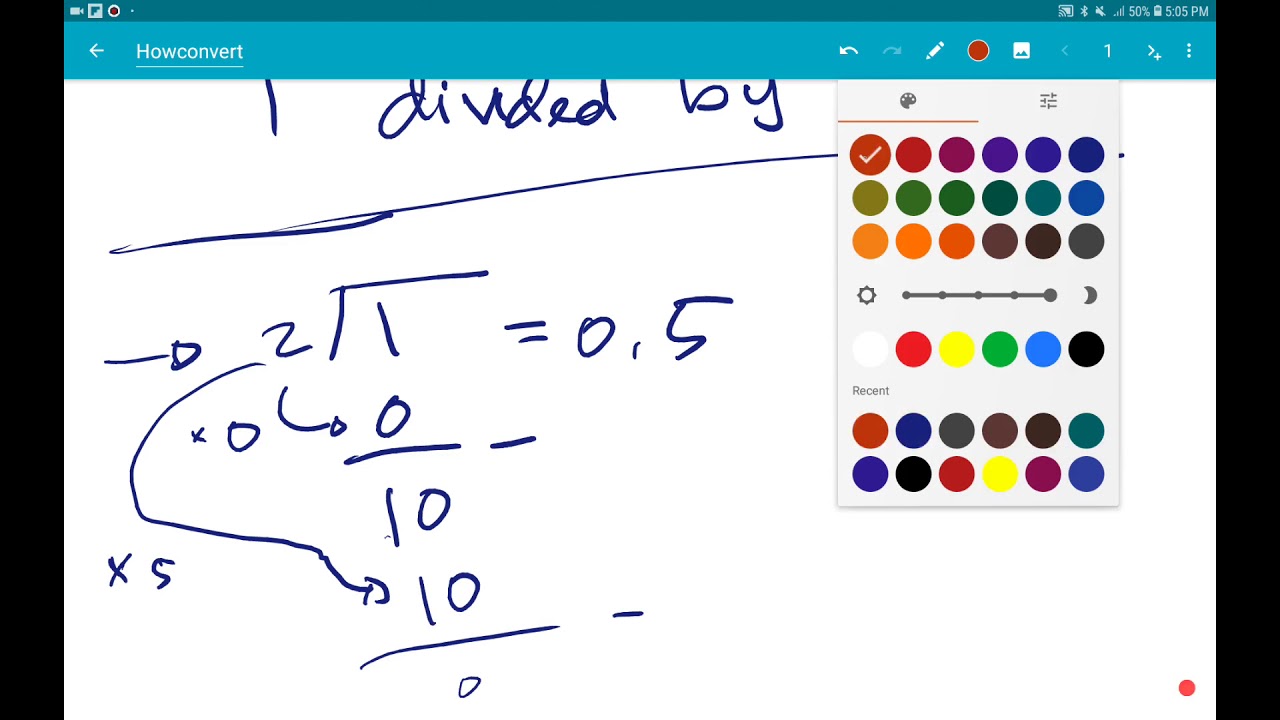

10 Divided By 1 2

10 Divided By 1 2

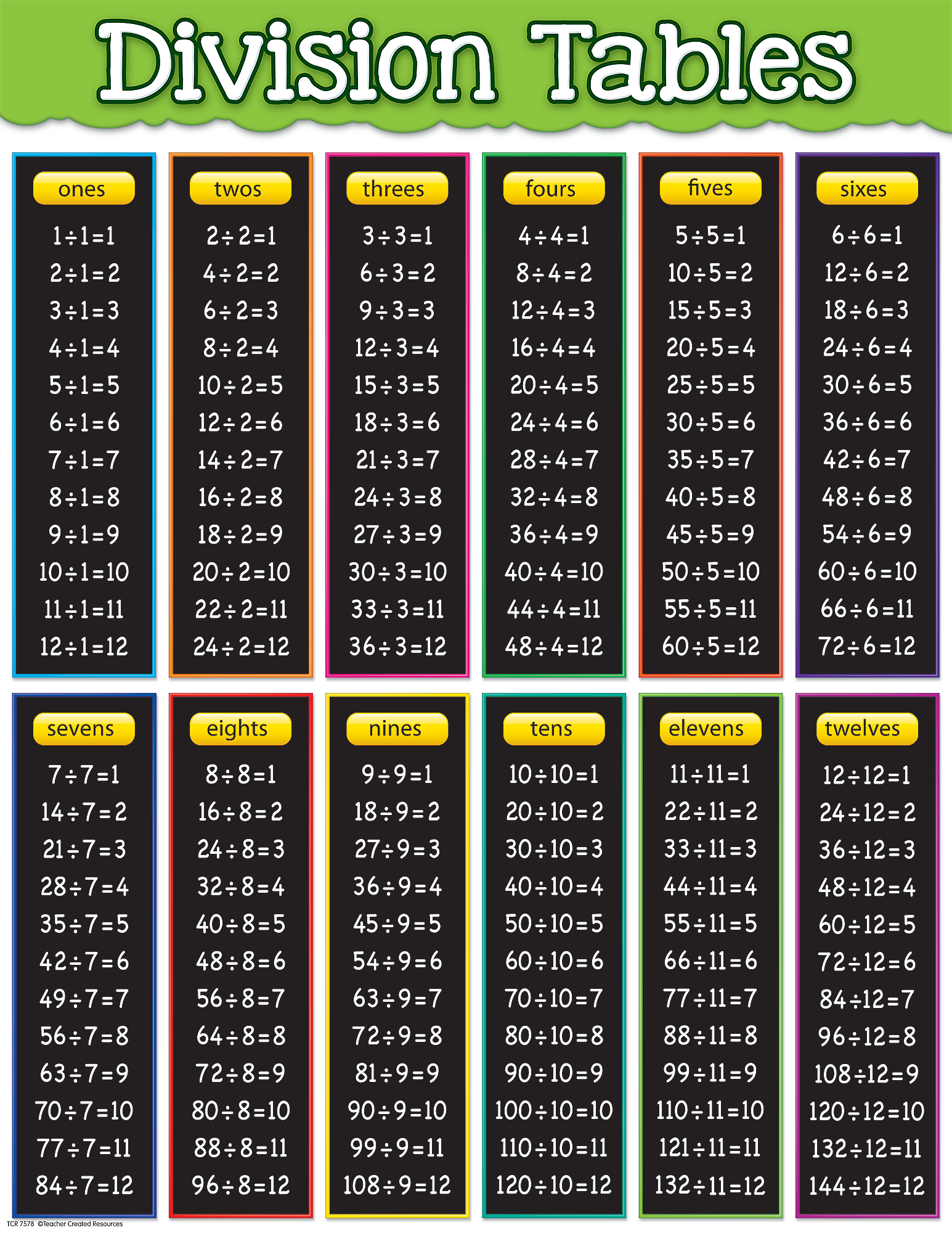

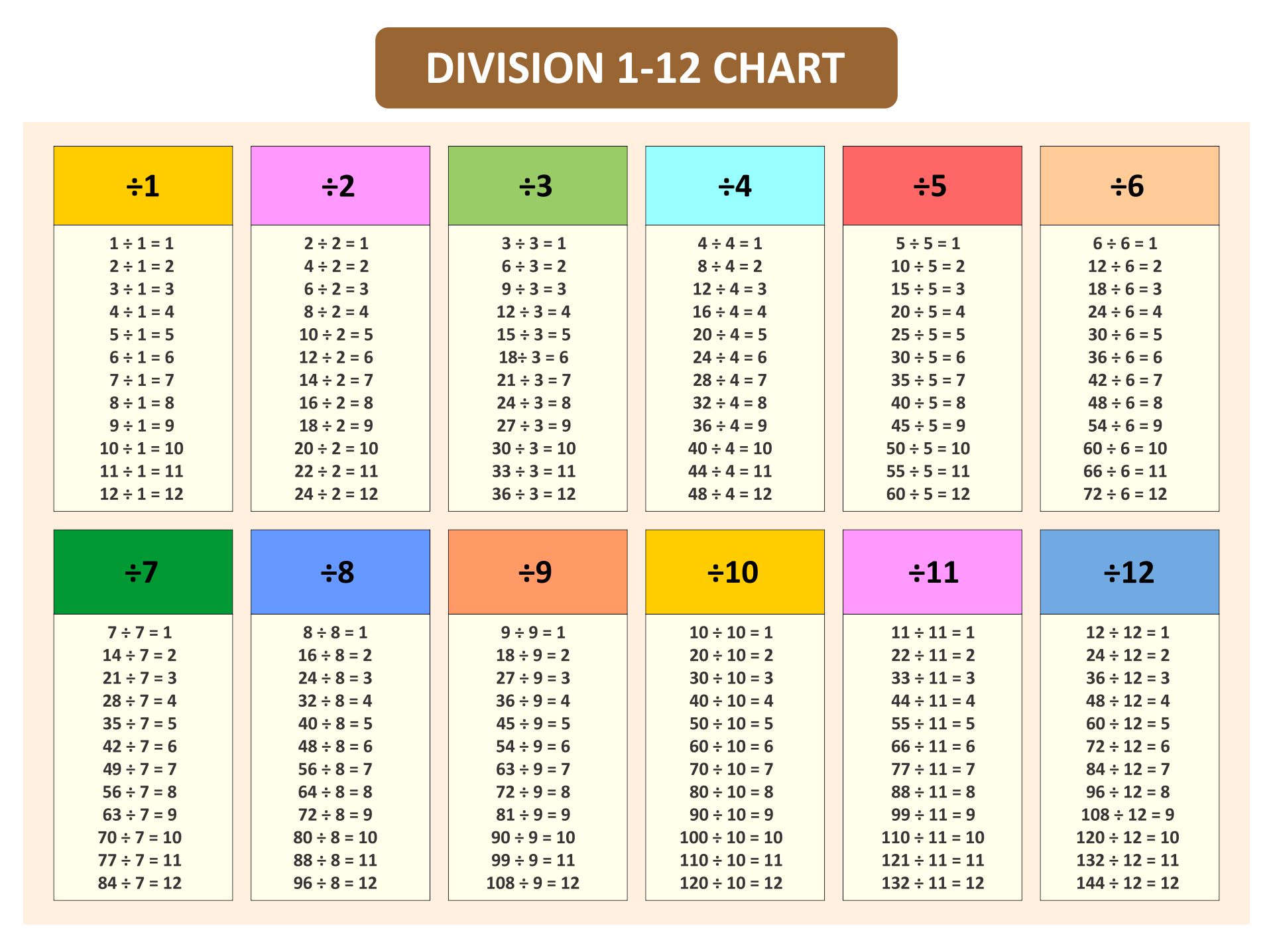

Blank Division Chart

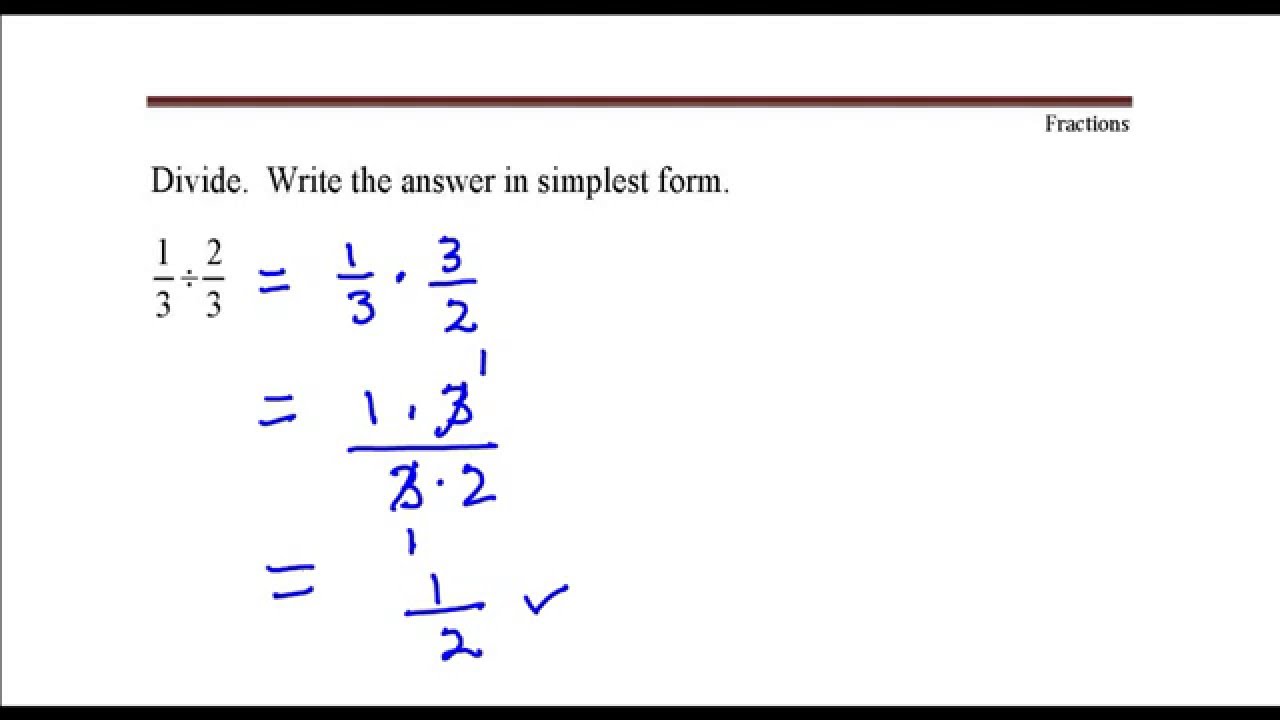

1 4 Divided By 2

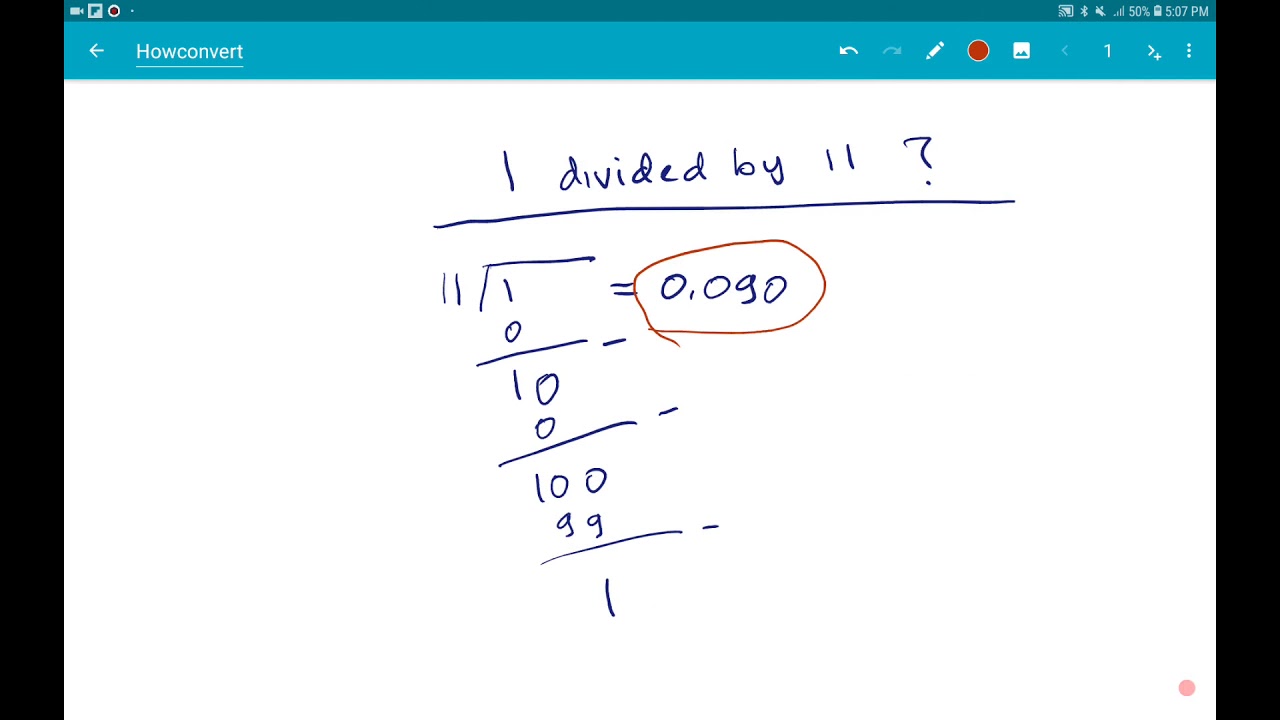

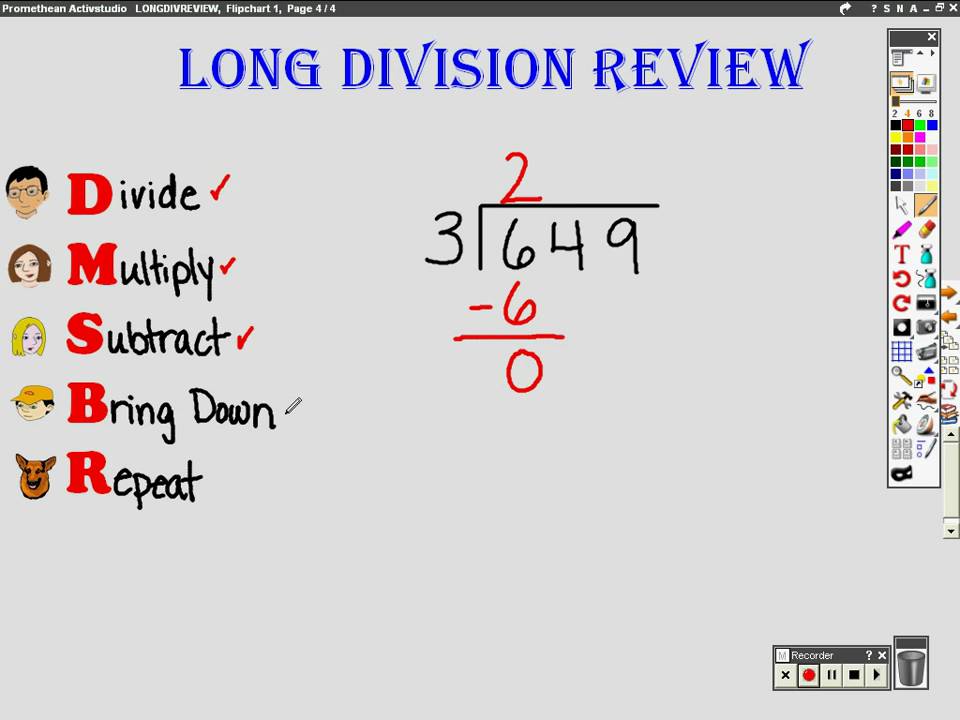

Long Division Decimals And Remainders

12 Divided By 100

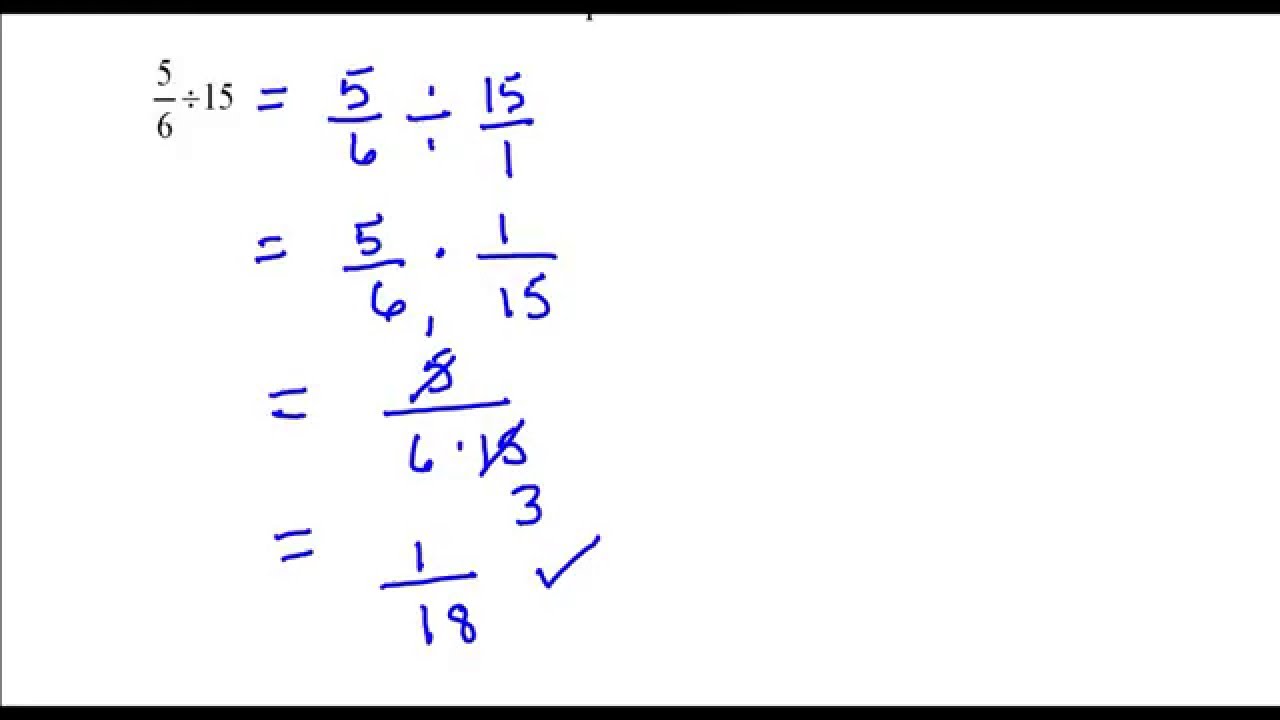

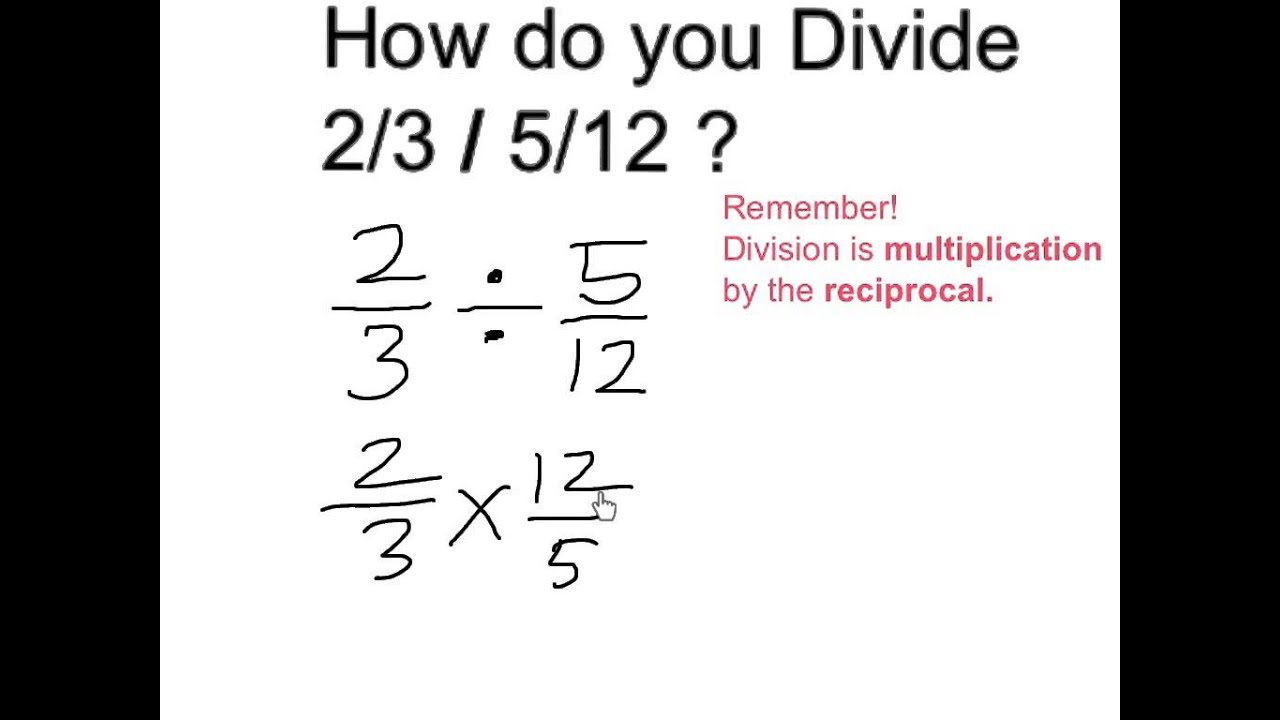

15 Divided By 2 Thirds