15 Times What Makes 60 - Organizing your daily tasks becomes effortless with free printable schedules! Whether you require a planner for work, school, or individual activities, these templates offer a practical method to stay on top of your responsibilities. Developed for flexibility, printable schedules are offered in various formats, including daily, weekly, and monthly designs. You can easily personalize them to suit your needs, guaranteeing your efficiency skyrockets while keeping everything in order. Most importantly, they're free and accessible, making it basic to prepare ahead without breaking the bank.

From managing appointments to tracking goals, 15 Times What Makes 60 are a lifesaver for anyone juggling multiple top priorities. They are perfect for trainees handling coursework, professionals coordinating meetings, or families balancing hectic routines. Download, print, and begin preparing right away! With a large range of designs readily available online, you'll find the perfect template to match your design and organizational requirements.

15 Times What Makes 60

15 Times What Makes 60

Form 1040 US Individual Income Tax Return Annual income tax return filed by citizens or residents of the United States Form 1040 PDF Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form1040 for instructions and the latest ... Form 1040, 1040-SR, or 1040-NR, line 10 .

U S Individual Income Tax Return IRS

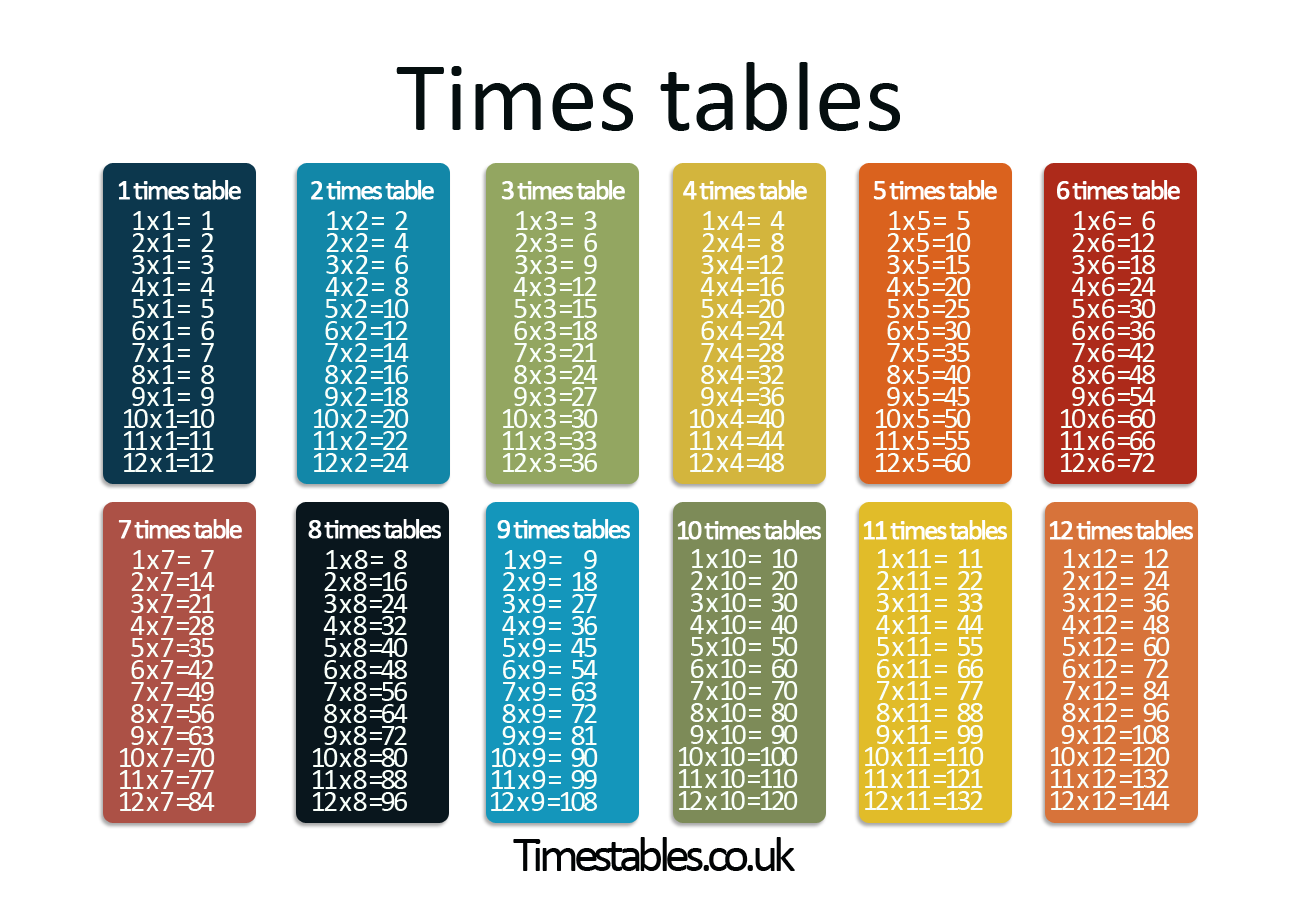

What Times What Is 24

15 Times What Makes 60(Sole Proprietorship). Attach to Form 1040, 1040-SR, 1040-SS, 1040-NR, or 1041; partnerships must generally file Form 1065. Go to www.irs.gov/ScheduleC for ... Form 1040 is used by US taxpayers to file an annual income tax return Current revision Form 1040 PDF Instructions for Form 1040 and Form 1040 SR Print

The latest versions of IRS forms, instructions, and publications. If a PDF file won't open, try downloading the file to your device and opening it using Adobe ... [img_title-17] [img_title-16]

2023 Schedule 1 Form 1040 IRS

[img_title-3]

Part II Explanation of Changes In the space provided below tell us why you are filing Form 1040 X Attach any supporting documents and new or changed forms [img_title-11]

Single Married filing jointly even if only one had income Married filing separately MFS Head of household HOH Qualifying surviving spouse QSS [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]