Form 990 Schedule B - Organizing your daily tasks becomes effortless with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates use a hassle-free way to remain on top of your obligations. Designed for versatility, printable schedules are readily available in numerous formats, consisting of daily, weekly, and monthly designs. You can easily tailor them to match your needs, ensuring your productivity soars while keeping whatever in order. Most importantly, they're free and available, making it basic to prepare ahead without breaking the bank.

From managing consultations to tracking goals, Form 990 Schedule B are a lifesaver for anybody juggling numerous concerns. They are perfect for students managing coursework, professionals coordinating meetings, or households stabilizing hectic routines. Download, print, and start preparing right now! With a wide variety of styles readily available online, you'll discover the ideal template to match your style and organizational requirements.

Form 990 Schedule B

Form 990 Schedule B

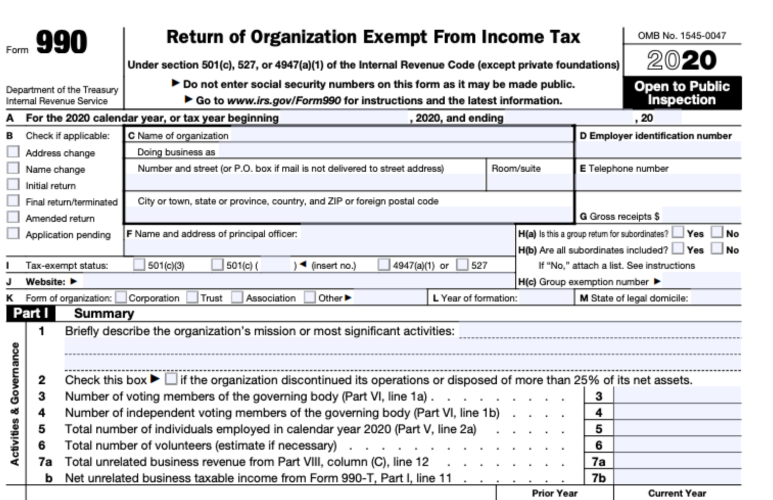

The following schedules to Form 990 Return of Organization Exempt from Income Tax do not have separate instructions IRS Form 990 Schedule B is a supplementary filing requirement of nonprofit organizations used to report details regarding the contributions they received during ...

Schedule B requirements Thomson Reuters

Free Schedule B Form 990 2023 Instructions and Details | PrintFriendly

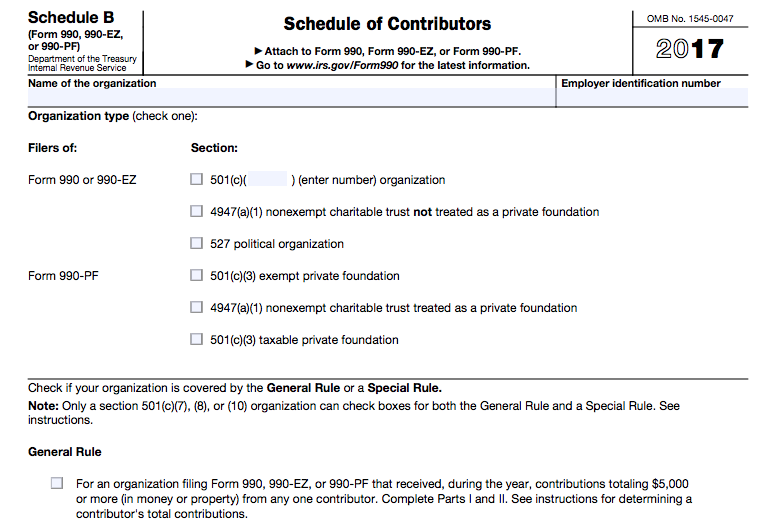

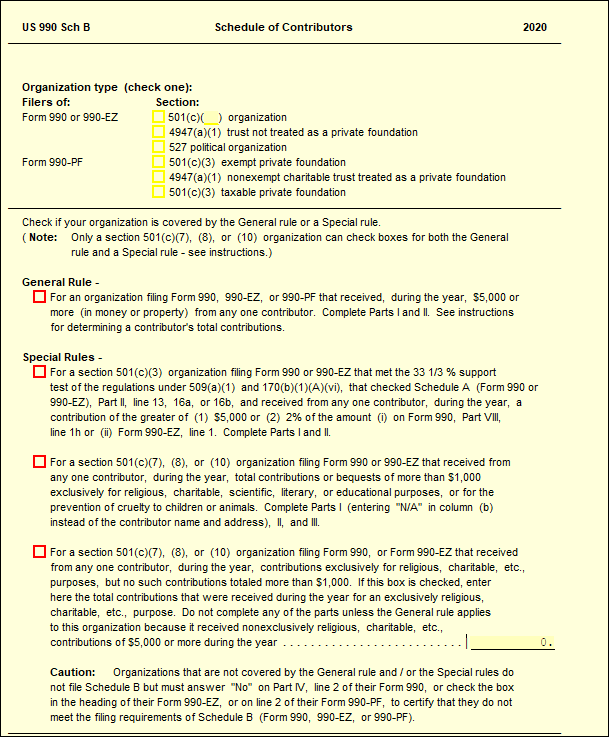

Form 990 Schedule BSchedule B, Schedule of Contributors is a supplementary schedule filed annually by tax-exempt organizations (Form 990/990-EZ) and private foundations (Form 990- ... Generally a nonprofit organization must file Schedule B with Form 990 if it receives contributions of the greater of 5 000 or more from any one contributor

All organizations must file Schedule B (Form 990 or 990-EZ) unless they certify that they do not meet the filing requirements at Schedule B (Form 990 or 9090-EZ) ... Supreme Court Holds California's Charity Donor Disclosure Requirement Unconstitutional | Tuple Legal What is Form 990's Schedule B? How Do I File? A Tax990 Guide! - Tax990

Form 990 Schedule B Instructions for 2024

IRS Dumps Schedule B For Associations, Others NPOs - The NonProfit Times

The general rule is marked for any organization that received a contribution greater than or equal to 5 000 from any 1 contributor How to Complete Schedule B for Form 990/990-EZ

Schedule B Form 990 or 990 EZ is used by organizations required to file Form 990 Return of Organization Exempt From Income Tax or Form 990 EZ Short Form About Form 990 Schedule B - Tax990 2006 Form 990, 990-EZ, or 990-PF (Schedule B)

Schedule B (Form 990) | Fill and sign online with Lumin

Final Treasury Regulations Address IRS Form 990 Schedule B Donor Disclosure Requirements

Schedule B (Form 990) | Fill and sign online with Lumin

Schedule B (990/EZ/PF) - Schedule of Contributors – UltimateTax Solution Center

What is Form 990 Schedule B? - YouTube

Form 990 Schedule B & Donor Disclosures: What's Required?

Form 990 Schedule B - Donor Disclosure Requirements - Labyrinth, Inc. | www.labyrinthinc.com

How to Complete Schedule B for Form 990/990-EZ

:max_bytes(150000):strip_icc()/ScheduleB-58dd6b2daf7347a0a466d1800d8d74e1.png)

What Is Schedule B (Form 1040): Interest and Ordinary Dividends?

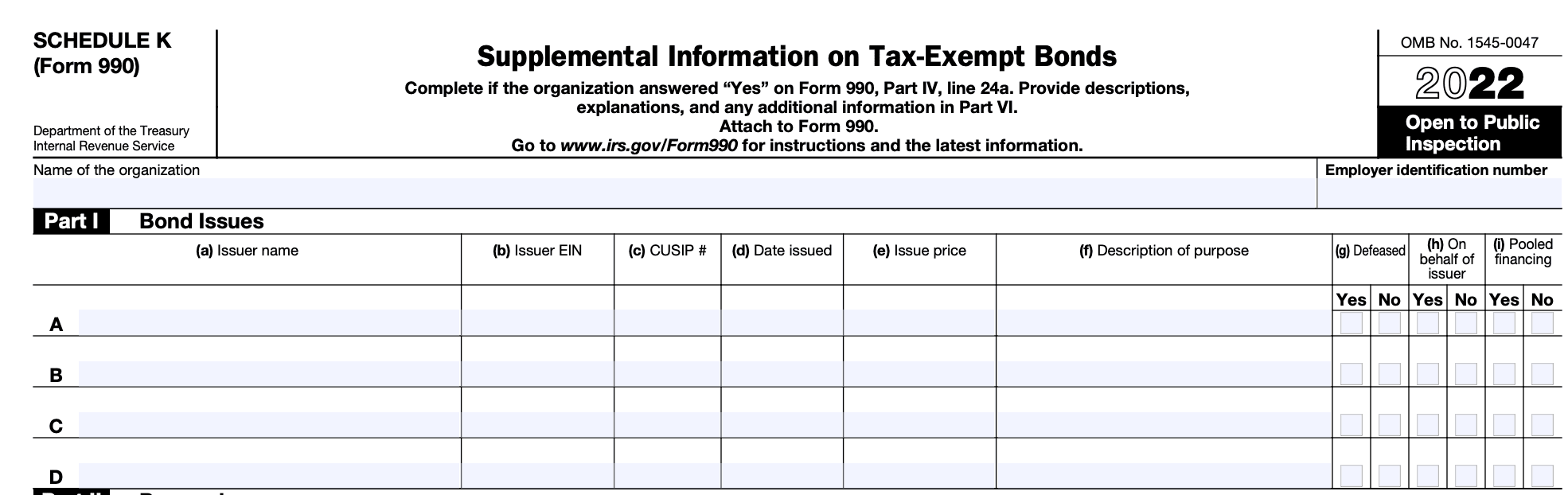

Form 990: Schedule K, Tax-Exempt Bond Details