1040 Schedule E Instructions - Organizing your everyday tasks becomes effortless with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates use a practical way to remain on top of your obligations. Created for versatility, printable schedules are offered in various formats, including daily, weekly, and monthly designs. You can quickly customize them to suit your requirements, ensuring your efficiency skyrockets while keeping everything in order. Best of all, they're free and accessible, making it easy to prepare ahead without breaking the bank.

From managing consultations to tracking goals, 1040 Schedule E Instructions are a lifesaver for anyone juggling multiple priorities. They are ideal for students managing coursework, professionals coordinating conferences, or families stabilizing busy routines. Download, print, and start planning right now! With a vast array of styles offered online, you'll discover the best template to match your design and organizational requirements.

1040 Schedule E Instructions

1040 Schedule E Instructions

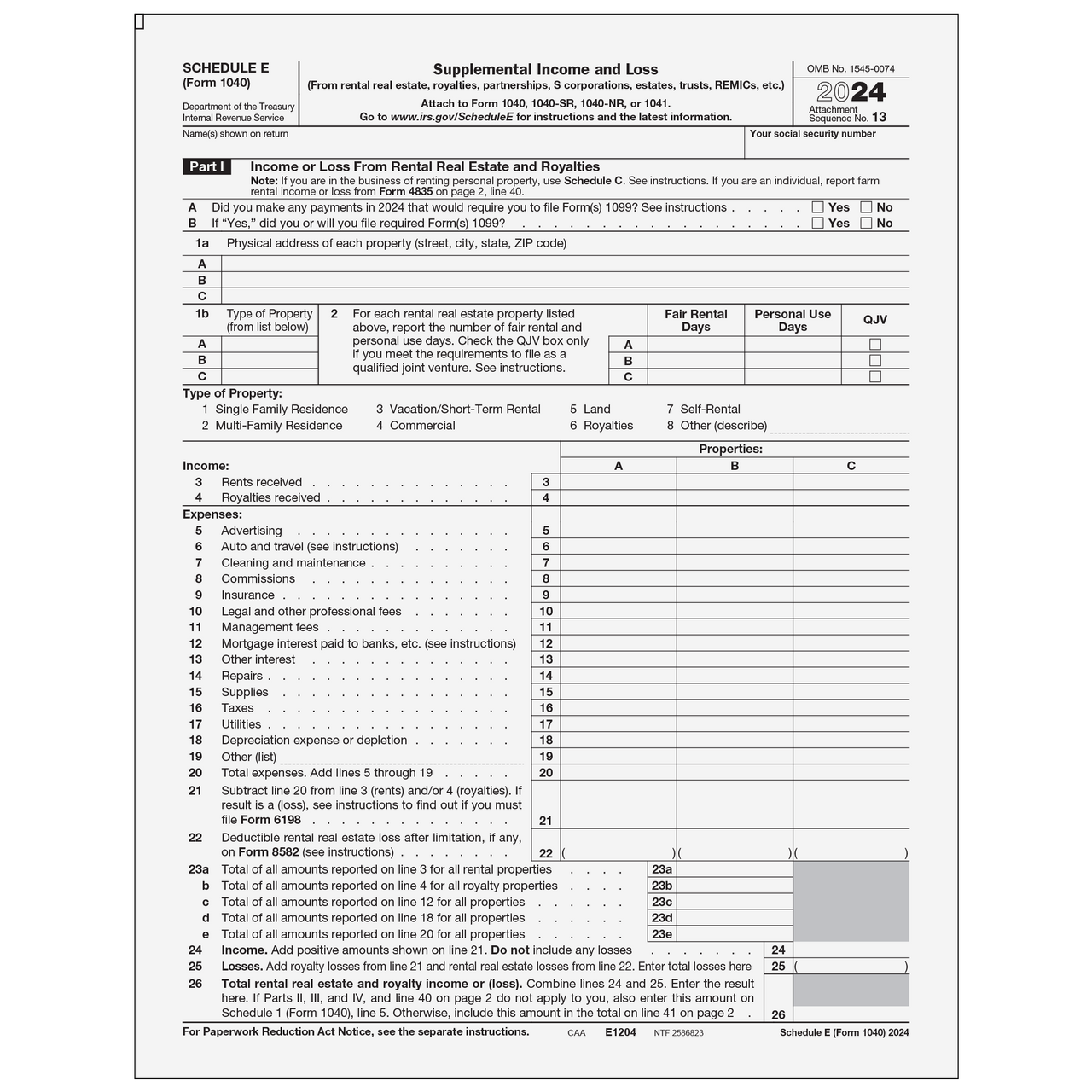

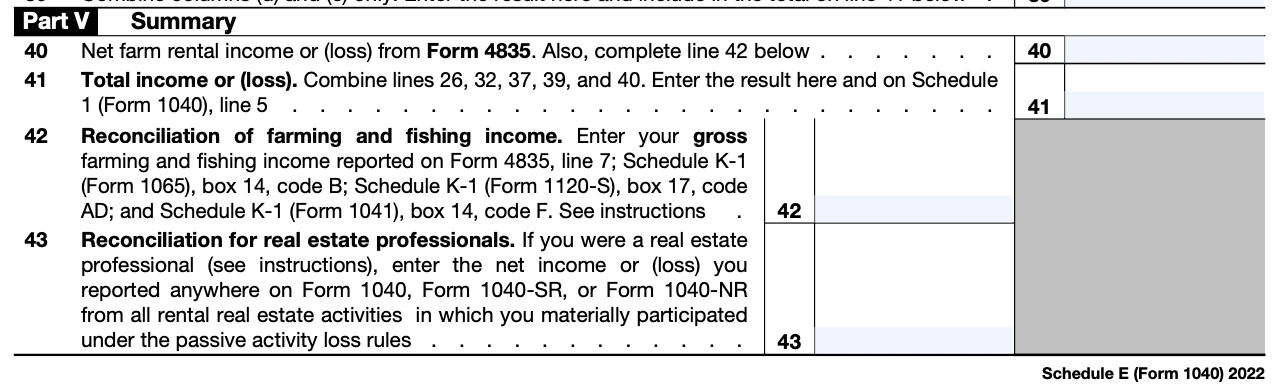

Step by Step Instructions for Form 1040 Schedule EFor each property enter the property s address type and fair rental days or personal use Attach to Form 1040, 1040-SR, 1040-NR, or 1041. Go to www.irs.gov/ScheduleE for instructions and the latest information. OMB No. 1545-0074. Attachment.

IRS Schedule E walkthrough Supplemental Income Loss

IRS Schedule E: The Ultimate Guide for Real Estate Investors

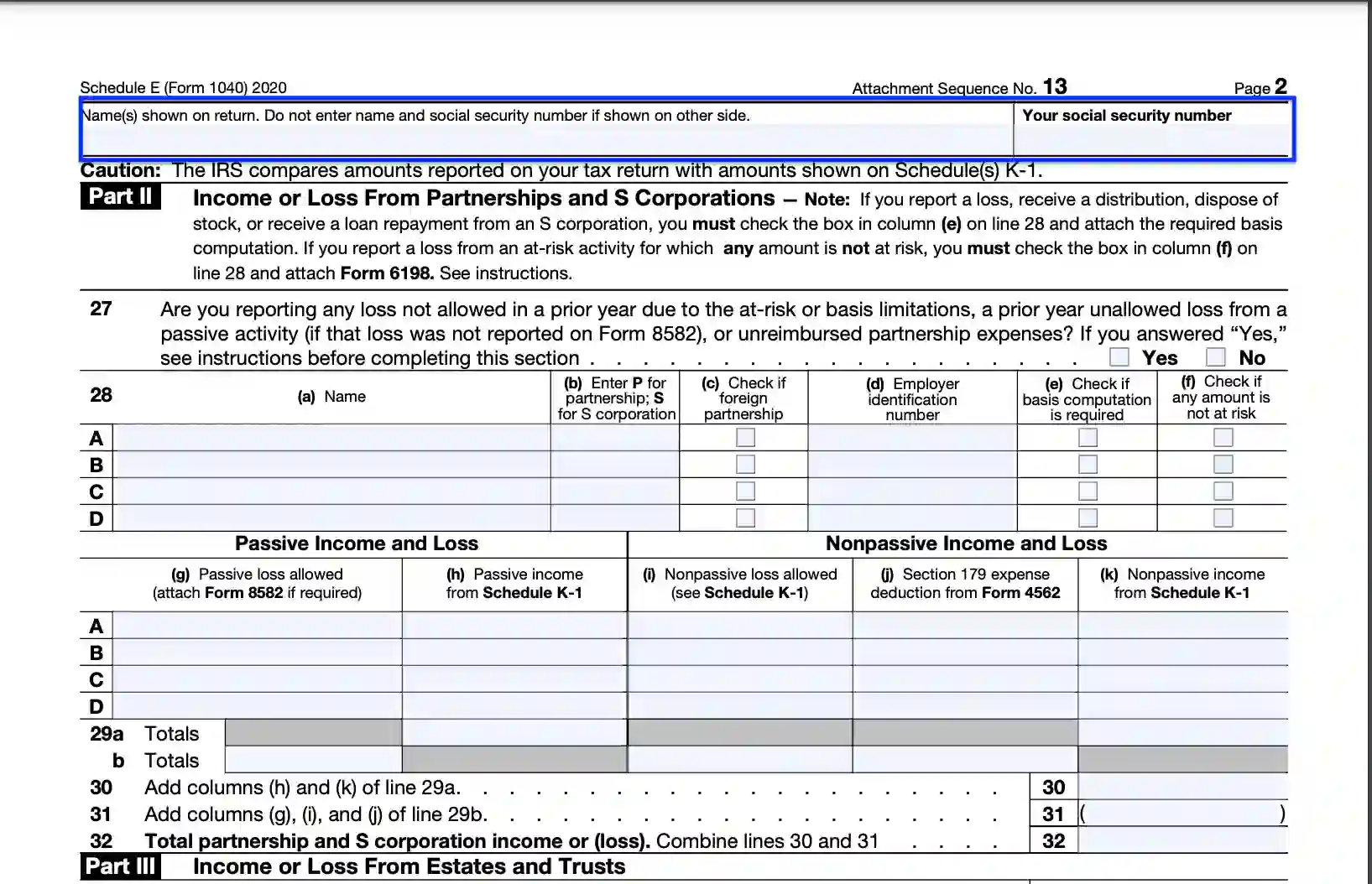

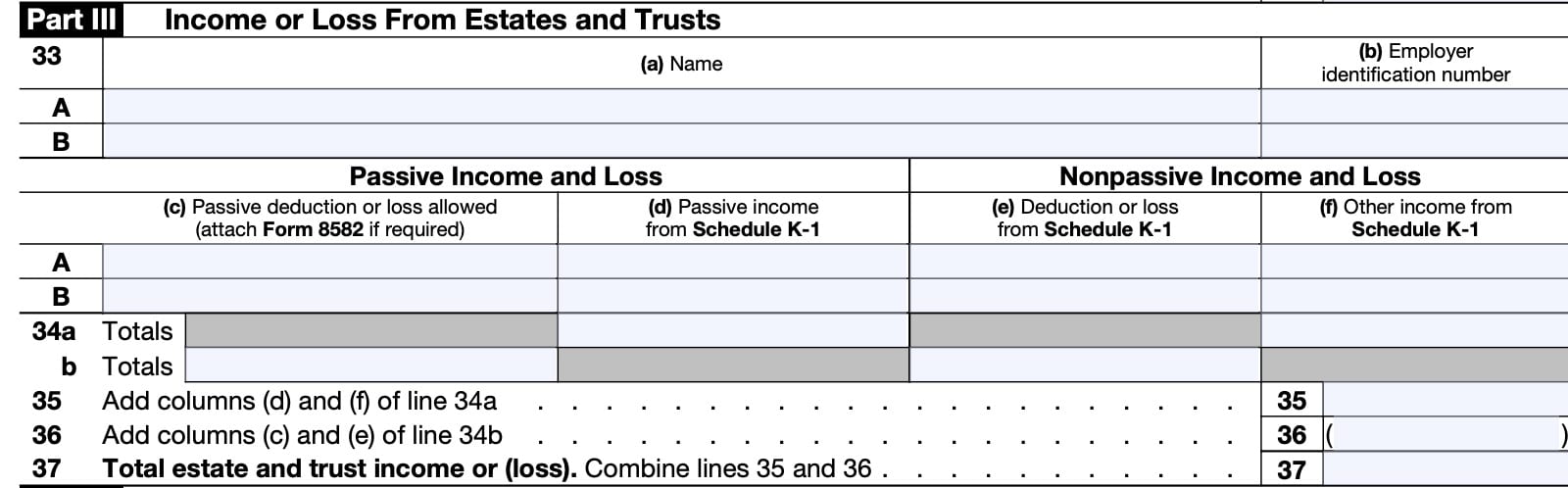

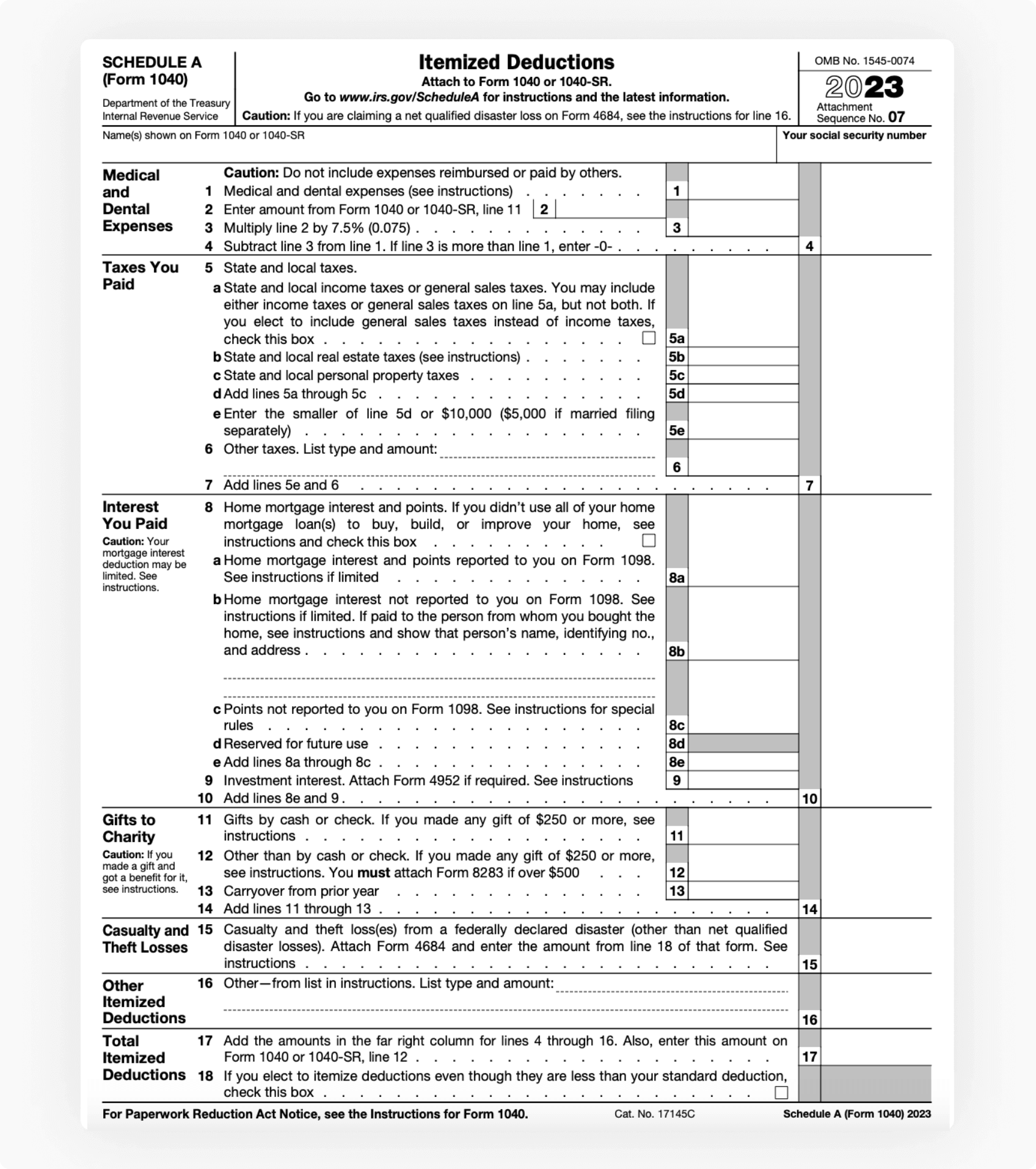

1040 Schedule E InstructionsSCHEDULE E. Supplemental Income and Loss. (Form 1040 or 1040-SR) (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc ... Use Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and residual interests

How do I fill this out? To fill out the IRS Schedule E Form 1040, gather your rental and royalty income information along with any related expenses. Free Schedule B (Form 1040) Instructions & Information | PrintFriendly What is IRS Form 1040 Schedule E?

2022 Schedule E Form 1040 Reginfo gov

E1204 - Form 1040 Schedule E Supplemental Income and Loss (Page 1 & 2) - Greatland.com

Taxpayers reporting supplemental income such as rental real estate income will file IRS Schedule E with their tax return Here s how 1040 Schedule A Instructions: Reduce Taxes with Itemized Deductions - pdfFiller Blog

How To Complete Schedule E Form 1040 A Step by Step GuideStep 1 Gather necessary informationStep 2 Understand the sectionsStep 3 Fill out Part I Form 1040 - Quick Guide To Fill Out Your Tax Effortlessly 2008 Instruction 1040 Schedule E

A Breakdown of your Schedule E Expense Categories – Landlord Studio

Schedule E Instructions: How to Fill Out Schedule E in 2024?

IRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

Schedule E Explained - IRS Form 1040 - Supplemental Income and Losses - YouTube

:max_bytes(150000):strip_icc()/ScheduleEp2-e4ad846baf204bc597a450e64168e1f7.png)

Form 1040 Schedule E: What Is It?

IRS Schedule E Instructions - Supplemental Income and Loss

IRS Schedule E walkthrough (Supplemental Income & Loss) - YouTube

1040 Schedule A Instructions: Reduce Taxes with Itemized Deductions - pdfFiller Blog

Schedule E (Form 1040): Supplemental Income and Loss

E1204 - Form 1040 Schedule E Supplemental Income and Loss (Page 1 & 2) - Greatland.com