1099 Nec Schedule C - Organizing your daily tasks becomes effortless with free printable schedules! Whether you require a planner for work, school, or personal activities, these templates use a convenient way to remain on top of your responsibilities. Created for flexibility, printable schedules are offered in different formats, consisting of everyday, weekly, and monthly layouts. You can easily customize them to fit your requirements, guaranteeing your performance skyrockets while keeping whatever in order. Most importantly, they're free and available, making it basic to plan ahead without breaking the bank.

From managing consultations to tracking objectives, 1099 Nec Schedule C are a lifesaver for anyone balancing several top priorities. They are perfect for trainees managing coursework, specialists collaborating meetings, or households stabilizing hectic routines. Download, print, and begin preparing right away! With a wide range of styles offered online, you'll find the ideal template to match your style and organizational requirements.

1099 Nec Schedule C

1099 Nec Schedule C

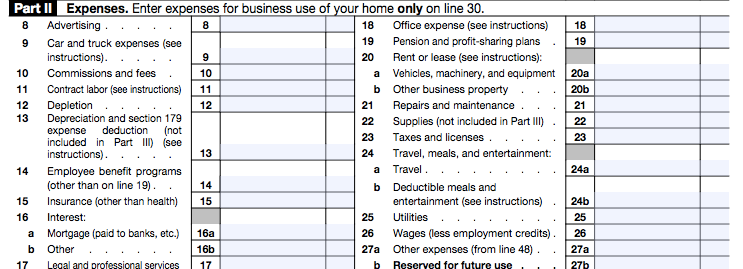

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor Your 1099-NEC income will then correctly show up on Schedule C and be subject to self-employment taxes. What if my income is not self-employment income?

What Is a Schedule C IRS form TurboTax Tax Tips Videos Intuit

What is a Schedule C? Instructions and examples for 2024

1099 Nec Schedule CIf you receive a Form 1099-NEC Nonemployee Compensation with an amount in Box 1, the IRS position is that you have your own business. Link the information from the 1099 NEC to Schedule C by selecting the Schedule C button and then selecting Continue If the Carried To section says None the

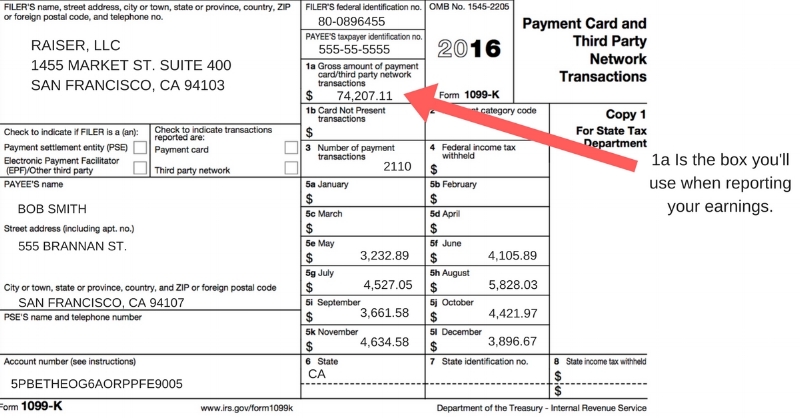

You'll now see your 1099-NEC and/or 1099-K amounts on the Business Income (Schedule C) line. This indicates that we've created a Schedule C for you based on ... Step-By-Step Instructions For Filing Form 1099-NEC | 1-800Accountant It is asking me to complete schedule C on my 1099-NEC - what is this

I do not have a business How do I enter my i Form 1099 NEC i

What is an IRS Schedule C Form?

As an independent contractor you ll use Form 1099 NEC to figure and report your nonemployee compensation on your return Learn more about this tax form What is an IRS Schedule C Form?

If you receive a 1099 NEC with income in Box 1 that is for nonemployee compensation the IRS requires that this income be reported on a Schedule C How to file the *new* Form 1099-NEC for independent contractors using TurboTax (formerly 1099-MISC) - YouTube How To File Taxes Using Your Uber 1099-NEC and 1099-K — Stride Blog

1099-NEC Conversion in 2020

What is Form 1099-NEC for Nonemployee Compensation

What Are Schedule C Taxes? — Stride Blog

How to Fill Out Your Schedule C Perfectly (With Examples!)

What is Form 1099-NEC and what should you do with it? - GoDaddy Blog

1099-NEC Schedule C won't fill in : r/TurboTax

How To File Taxes Using Your Uber 1099-NEC and 1099-K — Stride Blog

What is an IRS Schedule C Form?

Form 1099-MISC vs Form 1099-NEC: How are they Different?

Schedule C Form: Everything You Need to Know - Ramsey