990 Schedule A - Organizing your daily tasks ends up being effortless with free printable schedules! Whether you require a planner for work, school, or individual activities, these templates provide a practical way to stay on top of your responsibilities. Developed for versatility, printable schedules are readily available in various formats, consisting of everyday, weekly, and monthly layouts. You can quickly customize them to suit your requirements, guaranteeing your performance skyrockets while keeping whatever in order. Best of all, they're free and available, making it easy to plan ahead without breaking the bank.

From handling consultations to tracking goals, 990 Schedule A are a lifesaver for anybody balancing several priorities. They are ideal for trainees handling coursework, specialists collaborating conferences, or households balancing hectic routines. Download, print, and begin preparing immediately! With a vast array of styles offered online, you'll find the ideal template to match your style and organizational requirements.

990 Schedule A

990 Schedule A

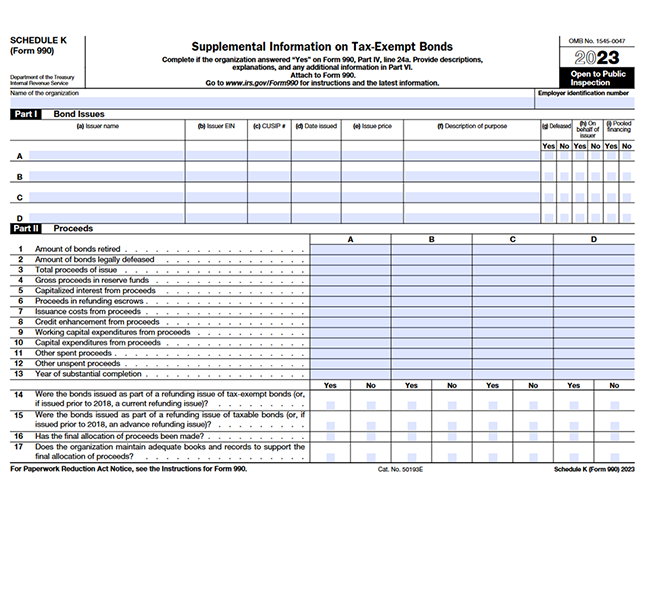

The purpose of Schedule A is to provide information about the public charity status and public support of the tax exempt entity This is how a Discover essential details on IRS Form 990 Schedule A for tax-exempt organizations. Simplify nonprofit reporting. Ensure compliance with IRS guidelines.

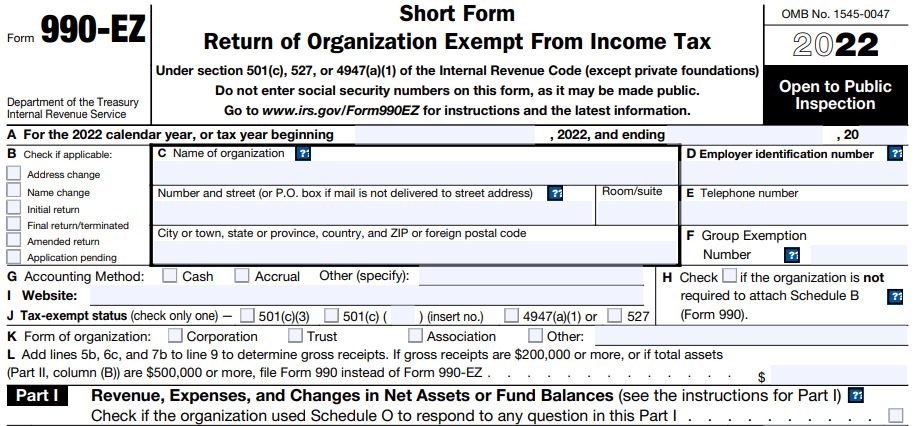

Form 990 EZ 990 Schedule A Instructions

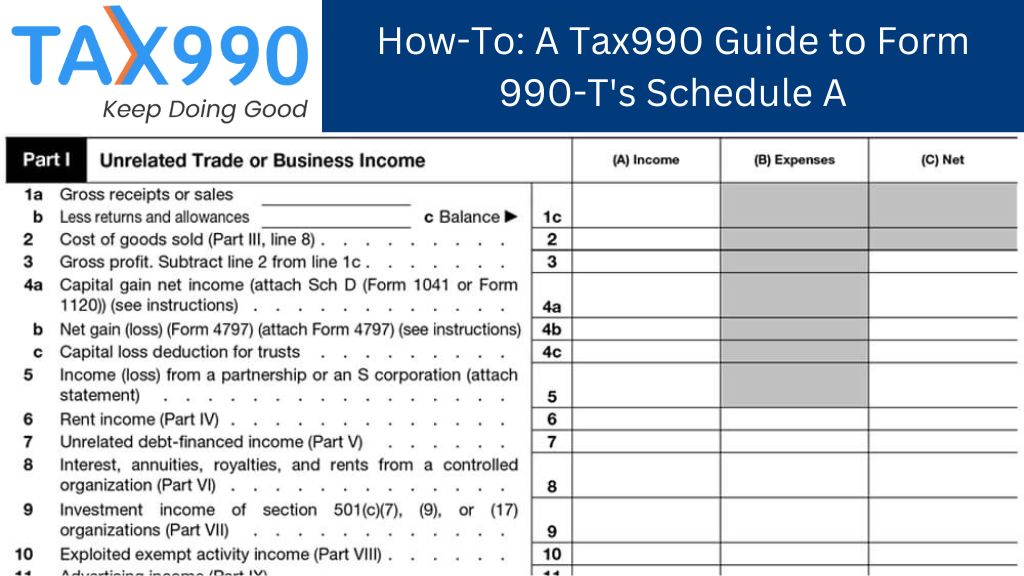

Schedule A (Form 990-T) | Fill and sign online with Lumin

990 Schedule ASchedule A (Form 990-EZ or Form 990) is used by nonprofits & tax exempt organizations to provide information about Public Charity Status & Public Support. Complete if the organization is a section 501 c 3 organization or a section 4947 a 1 nonexempt charitable trust Attach to Form 990 or Form 990 EZ Go to

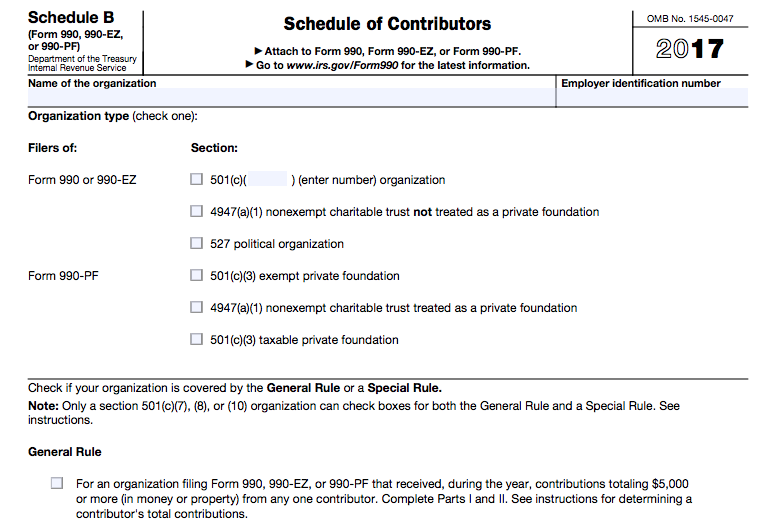

Schedule A is a complex but important schedule as it determines if a 501(c)(3) organization qualifies as a public charity based on the types of ... Schedule B (990/EZ/PF) - Schedule of Contributors – UltimateTax Solution Center Nonprofit Tax Tidbits: Form 990 Schedule C - Hawkins Ash CPAs

Form 990 Schedule A Tax Exempt Organizations TaxZerone

How-To: A Tax990 Guide to Form 990-T's Schedule A - Tax990

In kind contributions of property but not of services should be reported on line 1 of Parts II and III of Schedule A and also on Form 990 Part VIII line 1g Effortless Form 990 & 990-EZ E-filing with ALL Schedules

This schedule is to provide required information about public charity status and public support Organizations that must file Schedule A include Form 990 Schedule A And How To Complete It With Tax990.com - YouTube Completing the Form 990 Schedule O in ProSeries

What Is Form 990 Schedule A? - YouTube

IRS Schedule A Form 990 or 990-EZ ≡ Fill Out Printable PDF Forms Online

Schedule A (Form 990-T) | Fill and sign online with Lumin

How to Complete Part III of Schedule A for Form 990/990-EZ

Form 990-EZ Schedule A | Public charity status Instruction

Webinar: What Every Nonprofit Needs to Know about Form 990 | Jones & Roth CPAs & Business Advisors

2023 Form IRS 990 - Schedule O Fill Online, Printable, Fillable, Blank - pdfFiller

Effortless Form 990 & 990-EZ E-filing with ALL Schedules

Mastering Form 990 Schedules: An Ultimate Nonprofit Guide - re: charity

IRS Dumps Schedule B For Associations, Others NPOs - The NonProfit Times