Donor Advised Fund Tax Deduction Rules - Organizing your daily tasks becomes uncomplicated with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates provide a hassle-free method to stay on top of your responsibilities. Developed for versatility, printable schedules are offered in numerous formats, including everyday, weekly, and monthly designs. You can easily personalize them to suit your needs, ensuring your efficiency soars while keeping everything in order. Most importantly, they're free and accessible, making it easy to plan ahead without breaking the bank.

From managing appointments to tracking objectives, Donor Advised Fund Tax Deduction Rules are a lifesaver for anybody balancing several top priorities. They are ideal for trainees managing coursework, professionals collaborating meetings, or households stabilizing hectic routines. Download, print, and begin preparing right away! With a vast array of styles offered online, you'll discover the best template to match your design and organizational needs.

Donor Advised Fund Tax Deduction Rules

Donor Advised Fund Tax Deduction Rules

These free printable gift tags are perfect to print and keep on hand so that when you have a birthday gift to give you ve already got one ready You'll love these free printable birthday gift tags! Great print at home option to add some flare to your next gift.

102 Free Printable Birthday Gift Tags Various Styles and Colors

Learn If A Donor Advised Fund Is Right For You Greater Cedar Rapids

Donor Advised Fund Tax Deduction RulesFind & Download Free Graphic Resources for Birthday Gift Tag Vectors, Stock Photos & PSD files. ✓ Free for commercial use ✓ High Quality Images. Make presents extra special with free printable gift tags templates you can easily customize for any occasion

Printable Happy Birthday Gift Tag Instructions. Download the PDF file; Print it in full color on white card stock. Cut out the tags, and punch ... How To Use Donor Advised Funds During The Season Of Giving What Is A Donor Advised Fund DAF And How Do They Work

Happy Birthday Gift Tags Favorite Printables

Donation Receipt Donation Receipt Forms Donation Receipt Template

Editable Happy Birthday Tags Happy Birthday Cake Tags Printable Birthday gift Tags Custom Gift Tag Labels Donor Advised Funds Are You Taking Advantage Of This Tax Strategy

FREE editable Happy Birthday tags to add to small trinket candy or pencil to bless your students on their birthday How Donor Advised Funds Work Park City Community Foundation How To Use Donor Advised Funds For Charitable Giving To Reduce Taxes

The BEST Roth Conversion Strategy For YOU Roth Conversions 2022

Donor Advised Fund Contributions You Can Direct Them Here Catholic

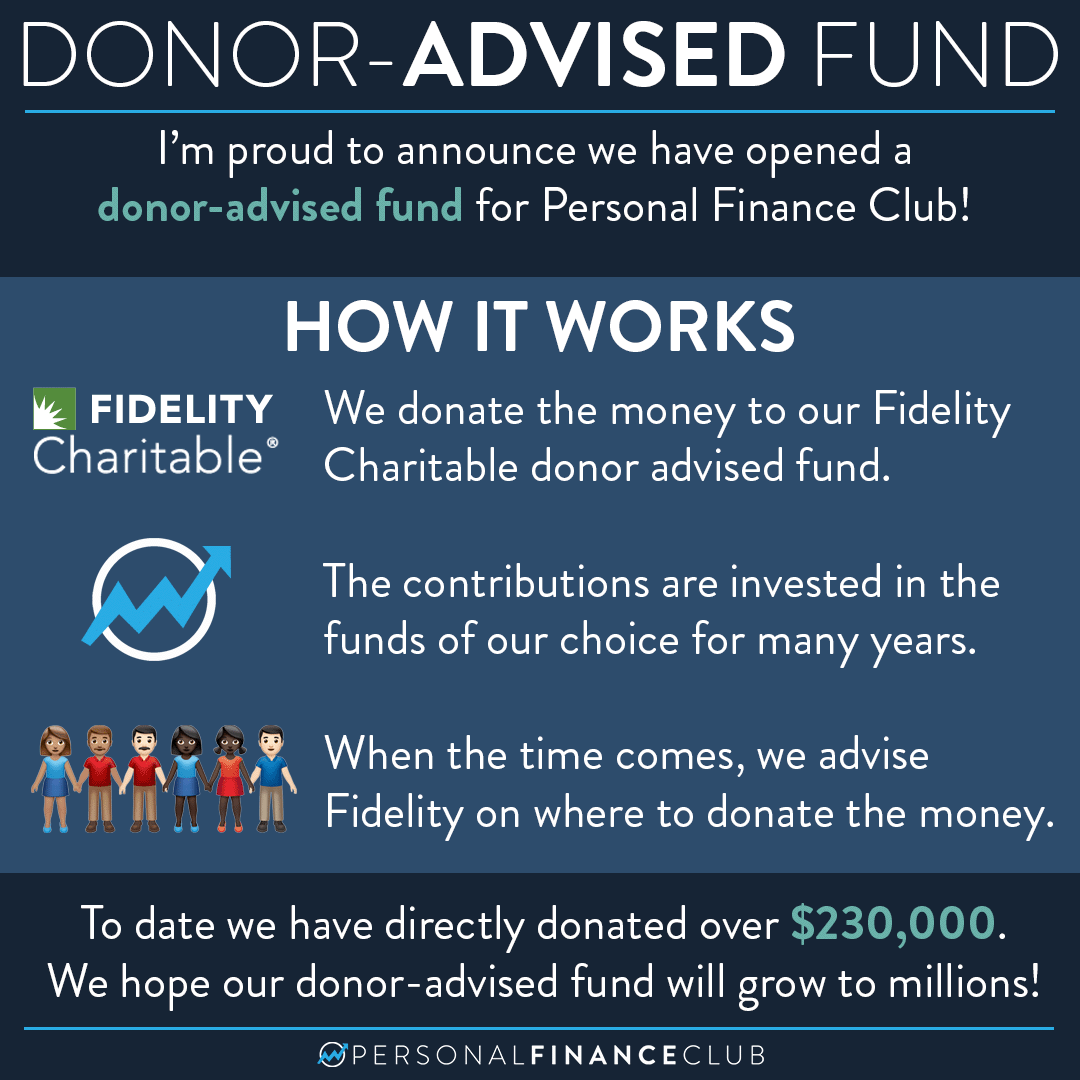

Personal Finance Club Has Opened A Donor Advised Fund Personal

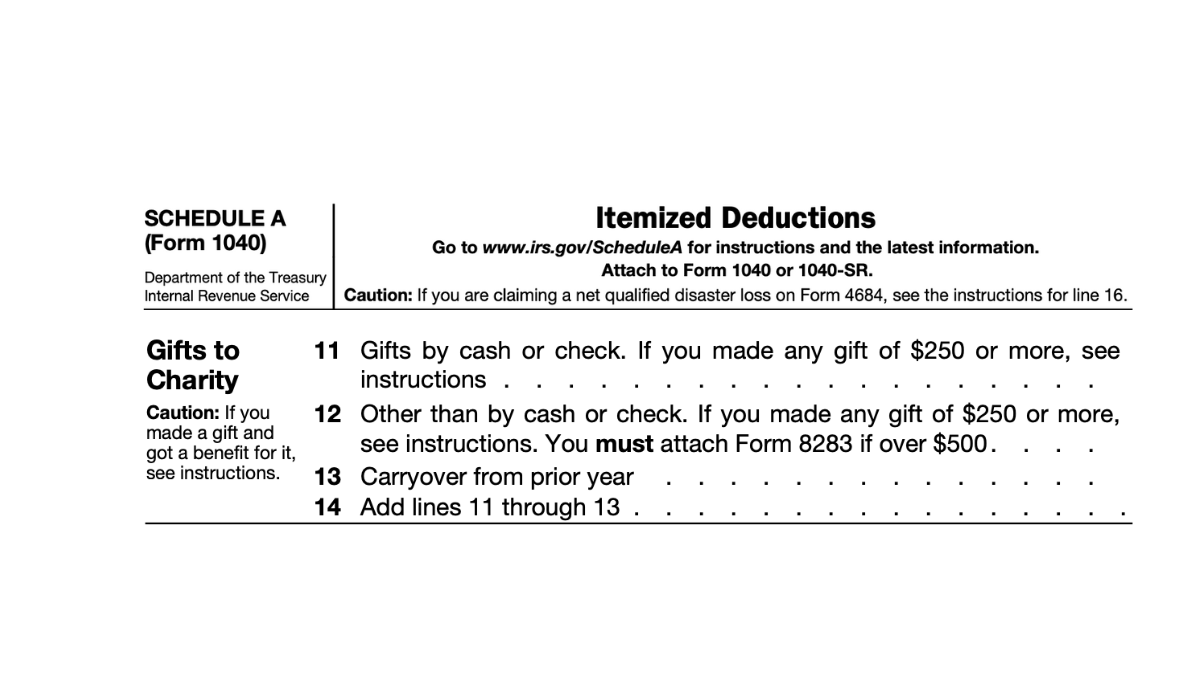

Make Sure You Claim Your Charitable Tax Deductions On Form 1040 Or

What Is A Donor Advised Fund Tax Strategy YouTube

Donor Advised Funds How To Turn Charitable Giving Into A Huge Tax

Need A GREAT Tax Deduction Use A Donor Advised Fund YouTube

Donor Advised Funds Are You Taking Advantage Of This Tax Strategy

MOAA How Recent Tax Reforms Affect Donor Advised Funds

Claiming Charitable Contributions On Your Tax Return