Instructions For Schedule M 3 - Organizing your everyday jobs ends up being uncomplicated with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates offer a hassle-free method to stay on top of your responsibilities. Created for versatility, printable schedules are available in various formats, consisting of everyday, weekly, and monthly designs. You can quickly customize them to match your needs, guaranteeing your efficiency skyrockets while keeping everything in order. Most importantly, they're free and accessible, making it simple to prepare ahead without breaking the bank.

From managing consultations to tracking goals, Instructions For Schedule M 3 are a lifesaver for anyone balancing multiple priorities. They are ideal for trainees managing coursework, experts collaborating conferences, or families balancing hectic routines. Download, print, and start preparing right away! With a wide variety of styles available online, you'll find the ideal template to match your style and organizational requirements.

Instructions For Schedule M 3

Instructions For Schedule M 3

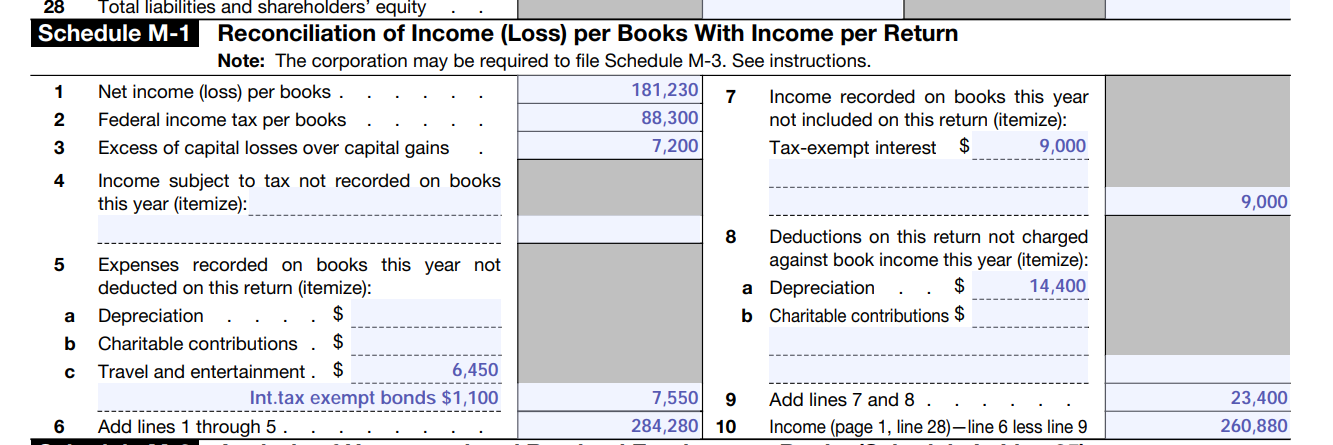

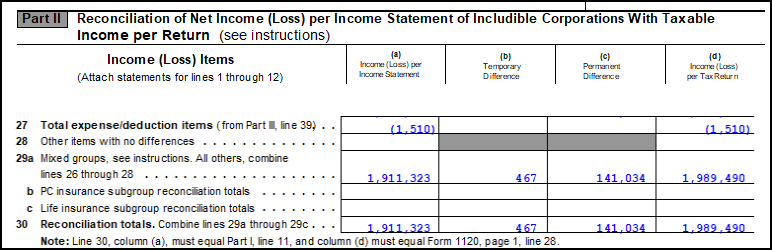

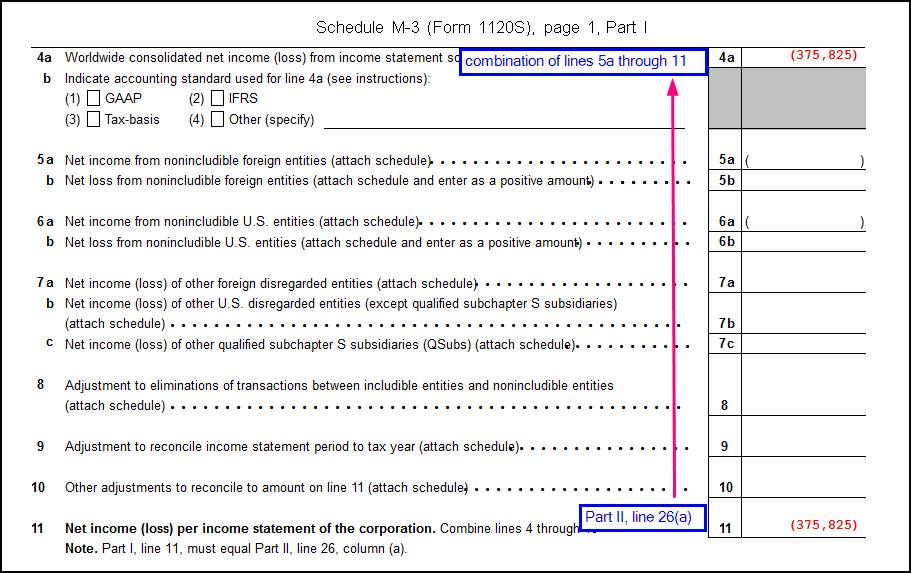

Purpose of Schedule group in order to determine if the group consolidated tax group files Form 1120 Schedule M 3 Part I asks certain Form 1120 Schedule M-3 FAQs on this page are organized to correspond with sections and line items described in the instructions for Schedule M-3.

Information about Schedule M 3 Intuit ProConnect

SOLUTION: Schedule M 3 Completed 1 - Studypool

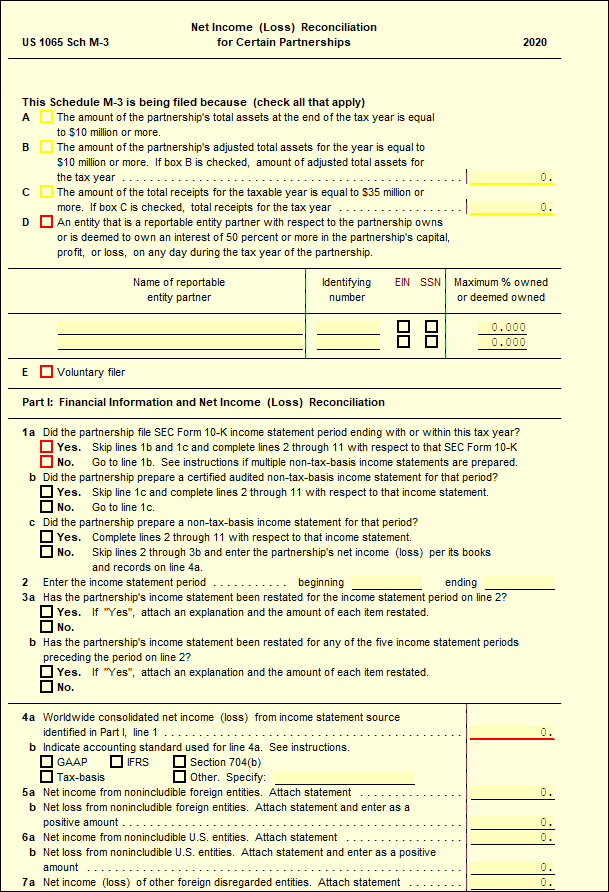

Instructions For Schedule M 3Any entity that files Form 1065 must file Schedule M-3 (Form 1065) if any of the following is true. A common trust fund or foreign partnership must file ... For insurance companies included in the consolidated U S income tax return see the instructions for Part I lines 10 and 11 and Part II line 7 for guidance

All columns must be completed for any part of Schedule M-3 that is filed. All applicable questions must be answered, all numerical data requested must be ... Drake Tax - 1120-S - Calculating Book Income, Schedule M-1 and M-3 Instructions for filing Form 1120-S: US Income Tax Return for an S Corporation | Lendstart

IRS Issues FAQs for Form 1120 Schedule M 3 Tax Notes

Instructions for Schedule M-3 (Form 1120-F)

If the total assets at the end of the corporation s tax year equal or exceed 10 million the corporation must file Schedule M 3 A corporation Solved 1. In this assignment, please help with Schedule M-1 | Chegg.com

Line 1 or credit net of elimination entries for Any domestic corporation or U S Check the financial statement type intercompany transactions between Untitled M-3 Schedule: Net Income Reconciliation for Corporations — Vintti

Drake Tax - 1120: Calculating Book Income, Schedule M-1 and M-3

Schedule M-3 Form 1065 Explained - YouTube

Schedule M-3 (1065) - Net Income (Loss) Reconciliation for Partnerships – UltimateTax Solution Center

Drake Tax - 1120-S - Calculating Book Income, Schedule M-1 and M-3

Form 1120s Instructions - How to File S Corp Taxes & Maximize Deductions | White Coat Investor

IRS Releases Draft Instructions for Schedules M-3

PDF) 2015 Form 1120 (Schedule M-3 | Tien Tran - Academia.edu

Solved 1. In this assignment, please help with Schedule M-1 | Chegg.com

What is the purpose of Schedule M-1 on Form 1120? - YouTube

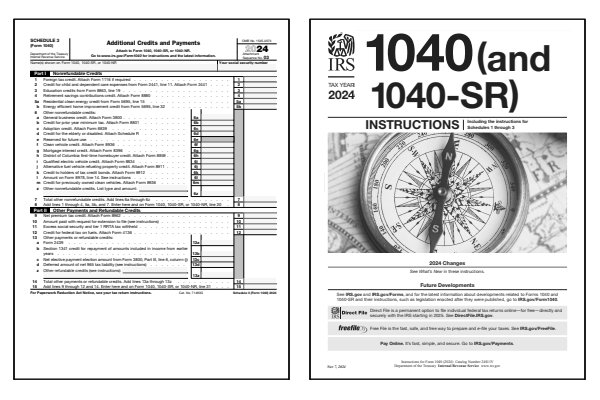

2024 Schedule 3 Form and Instructions (Form 1040)