Partnership Basis Schedule Pdf - Organizing your daily tasks becomes uncomplicated with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates offer a convenient way to stay on top of your duties. Created for flexibility, printable schedules are readily available in various formats, consisting of daily, weekly, and monthly designs. You can quickly tailor them to match your needs, guaranteeing your productivity soars while keeping everything in order. Most importantly, they're free and available, making it simple to plan ahead without breaking the bank.

From managing consultations to tracking goals, Partnership Basis Schedule Pdf are a lifesaver for anybody balancing numerous priorities. They are ideal for trainees handling coursework, experts collaborating conferences, or families stabilizing hectic routines. Download, print, and begin planning right now! With a vast array of designs offered online, you'll find the ideal template to match your style and organizational needs.

Partnership Basis Schedule Pdf

Partnership Basis Schedule Pdf

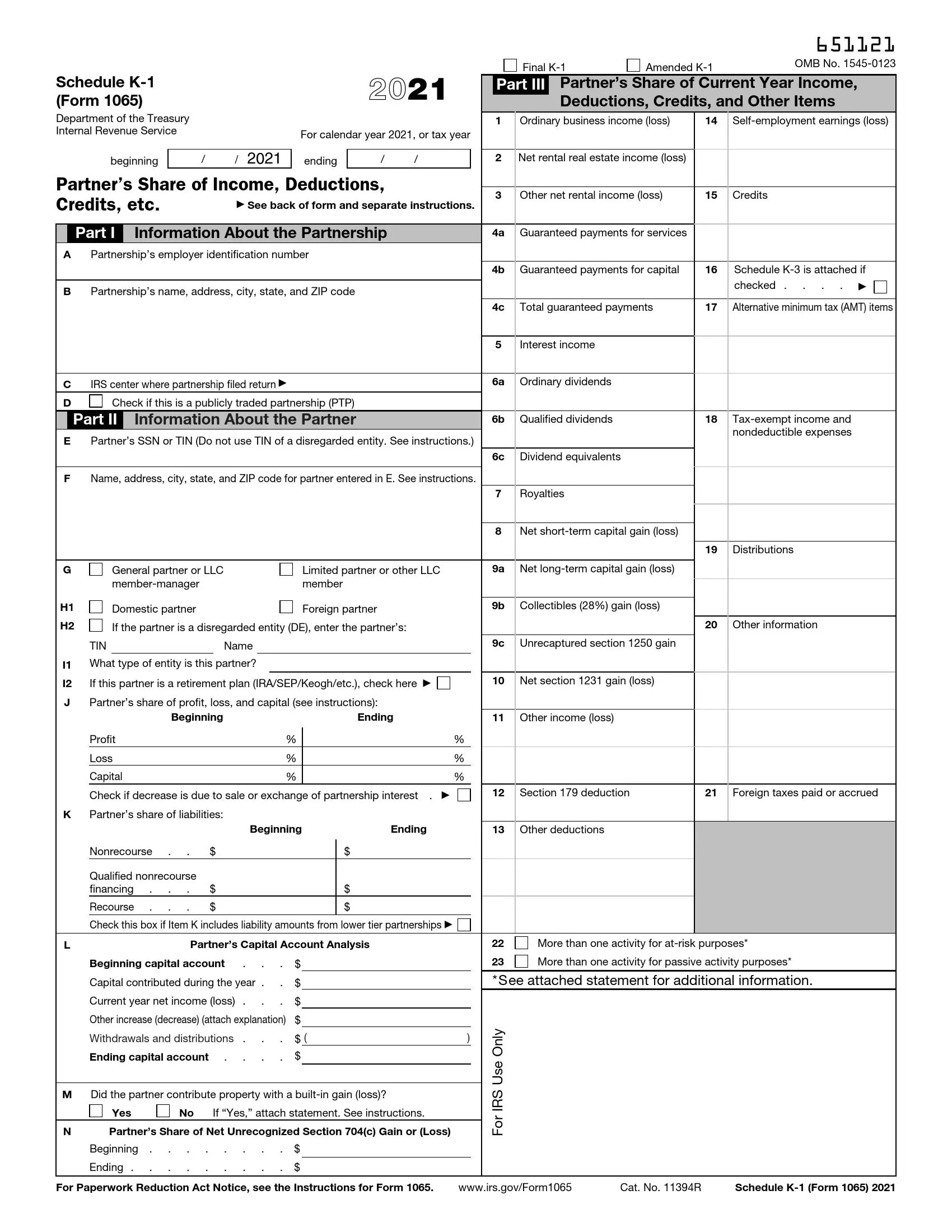

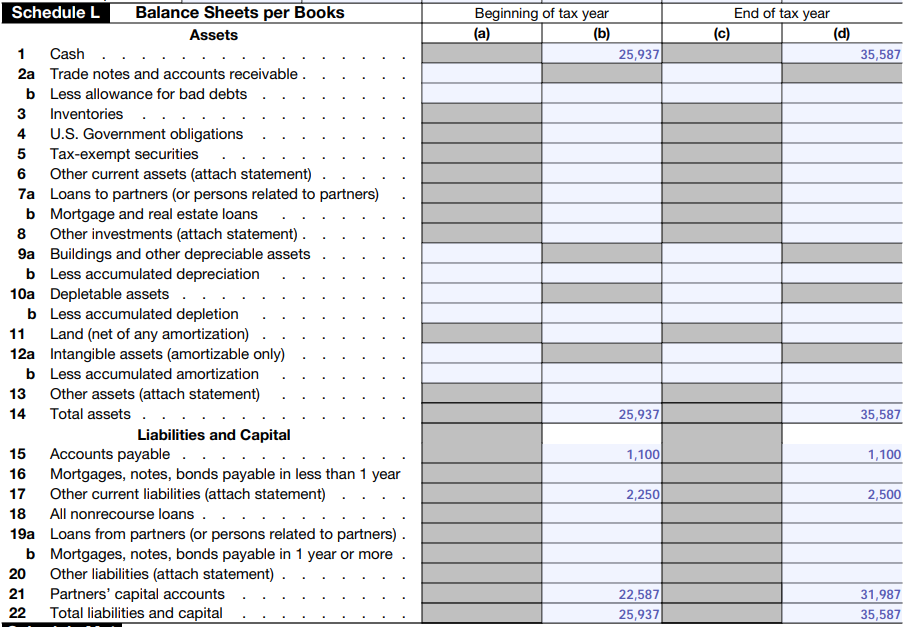

The Instructions provide much anticipated guidance on the required tax basis capital account reporting for tax year 2020 As discussed in detail RE: Urgent Action Needed on Partnership Tax Basis Reporting Requirement ... requires a beginning tax basis calculation for each partner.

Basis of A Partnership Center for Agricultural Law and Taxation

Solved What will be my tax basis in the partnership? show | Chegg.com

Partnership Basis Schedule PdfUse the Worksheet for Adjusting the. Basis of a Partner's Interest in the. Partnership, later, to figure the basis of your interest in the partnership. Beginning January 1 2024 partnerships are required to file Form 1065 and related forms and schedules electronically if they file 10 or more returns of any

This document addresses the forms, schedules, and worksheets used to report partnership and S Corporation activities in UltraTax CS.® It is designed to help you ... 1065 K-1 Package Print Guide Reporting publicly traded partnership Sec. 751 ordinary income and other challenges

Partnership Tax Basis Reporting Requirement Texas Society of CPAs

Reporting publicly traded partnership Sec. 751 ordinary income and other challenges

Under the most recent draft instructions for tax year 2020 all partnerships must report each partner s tax basis capital using the transactional method How do you use the Partner's Adjusted Basis Worksheet when preparing taxes for an LLC? - YouTube

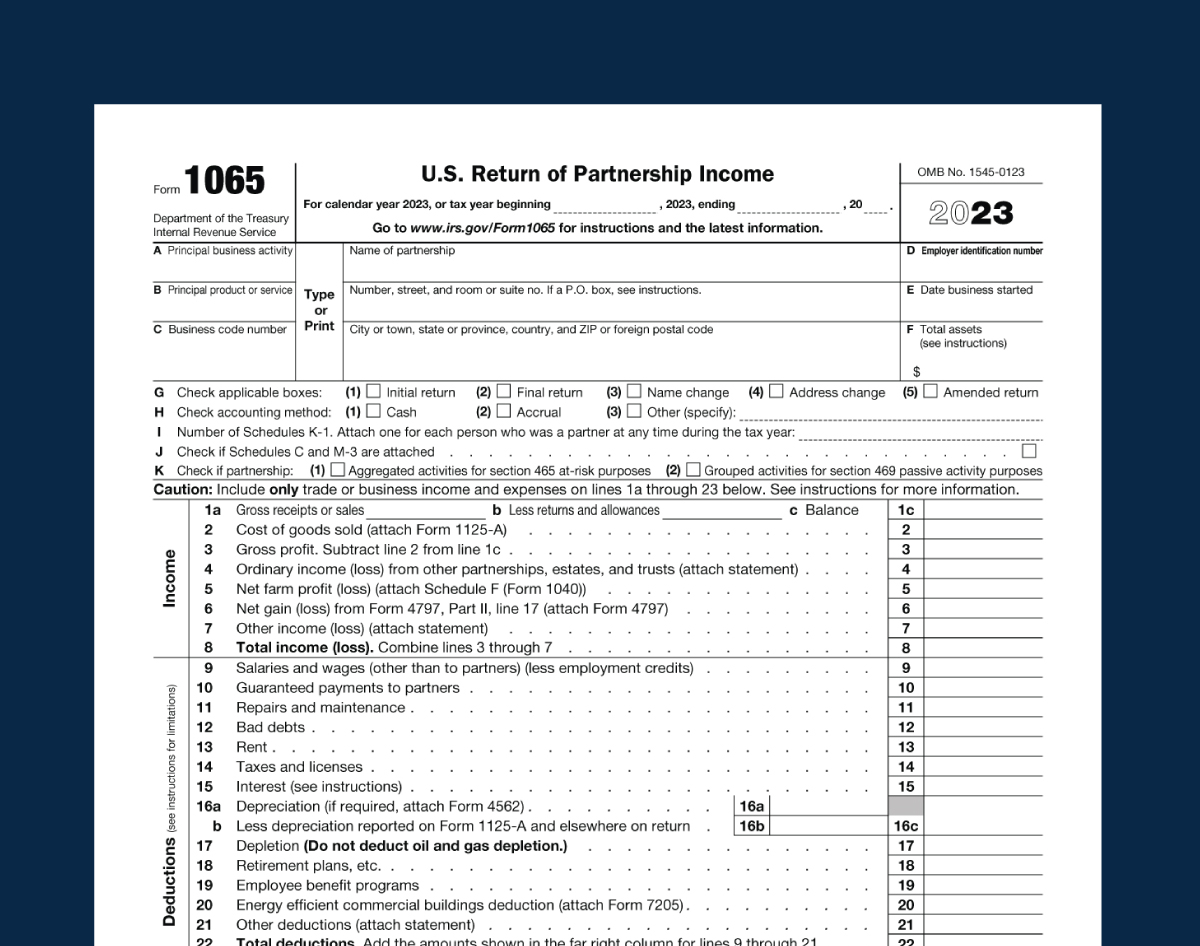

A worksheet for adjusting the basis of a partner s interest in the partnership is found in the Partner s Instructions for Schedule K 1 Form 1065 IRS Form 1065 ≡ Fill Out Printable PDF Forms Online Form 1065 Instructions: U.S. Return of Partnership Income

2023 Form IRS 1065 - Schedule D Fill Online, Printable, Fillable, Blank - pdfFiller

IRS Schedule K-1 Form 1065 ≡ Fill Out Printable PDF Forms Online

Free partnership basis calculation worksheet, Download Free partnership basis calculation worksheet png images, Free Worksheets on Clipart Library

Form 1065 Step-by-Step Instructions (+Free Checklist)

U.S. Return of Partnership Income

Schedule K-1 (Form 1065) - Partnership (Overview) – Support

Partner Basis Worksheet Template Excel - Worksheets Library

How do you use the Partner's Adjusted Basis Worksheet when preparing taxes for an LLC? - YouTube

Free partnership basis worksheet, Download Free partnership basis worksheet png images, Free Worksheets on Clipart Library

Form 1065 Instructions: U.S. Return of Partnership Income