Schedule 3 Line 15 - Organizing your everyday jobs becomes simple and easy with free printable schedules! Whether you require a planner for work, school, or individual activities, these templates use a convenient way to remain on top of your obligations. Developed for flexibility, printable schedules are readily available in numerous formats, consisting of daily, weekly, and monthly layouts. You can easily personalize them to match your needs, guaranteeing your performance soars while keeping whatever in order. Best of all, they're free and accessible, making it simple to plan ahead without breaking the bank.

From managing appointments to tracking objectives, Schedule 3 Line 15 are a lifesaver for anybody juggling multiple top priorities. They are ideal for students handling coursework, professionals coordinating conferences, or households balancing busy routines. Download, print, and begin preparing right now! With a vast array of designs offered online, you'll find the ideal template to match your design and organizational requirements.

Schedule 3 Line 15

Schedule 3 Line 15

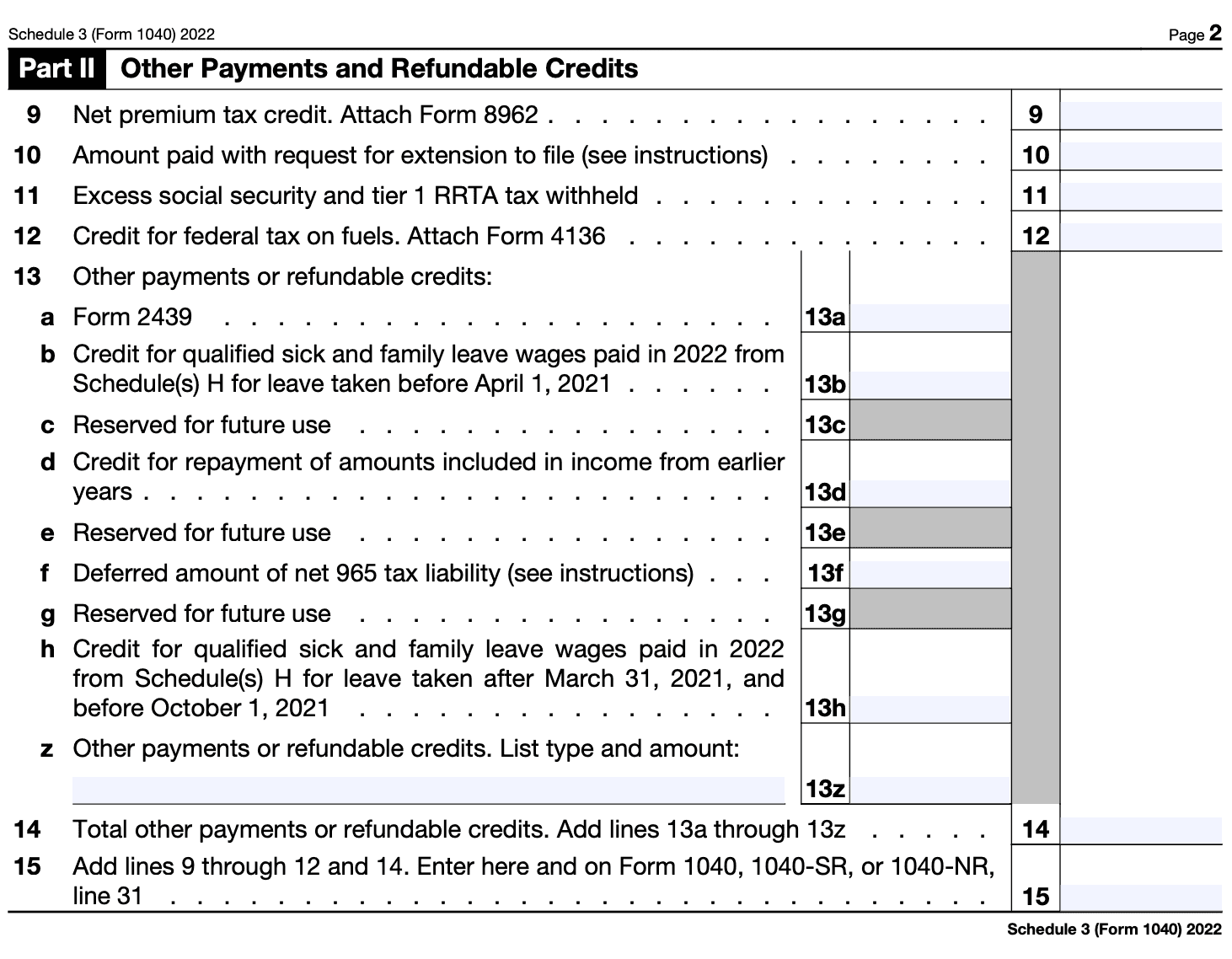

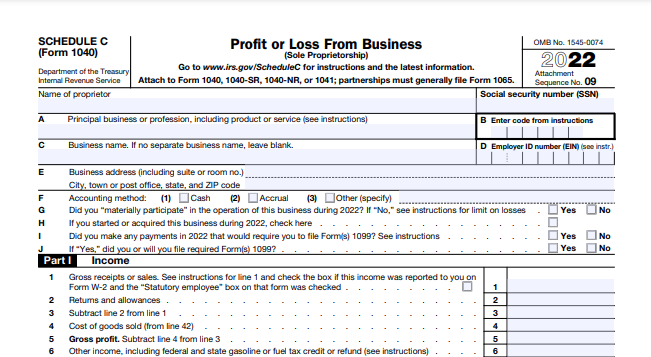

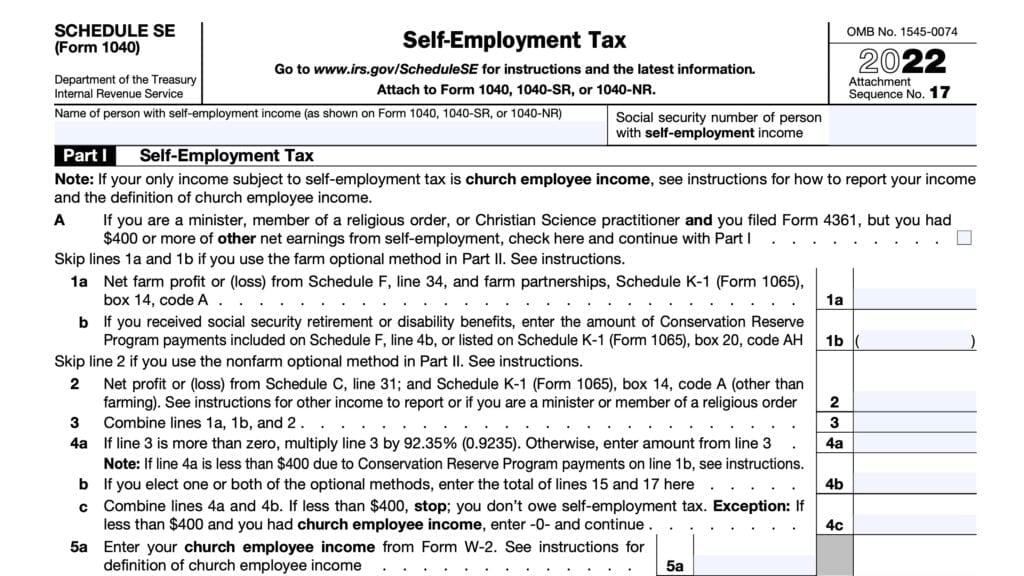

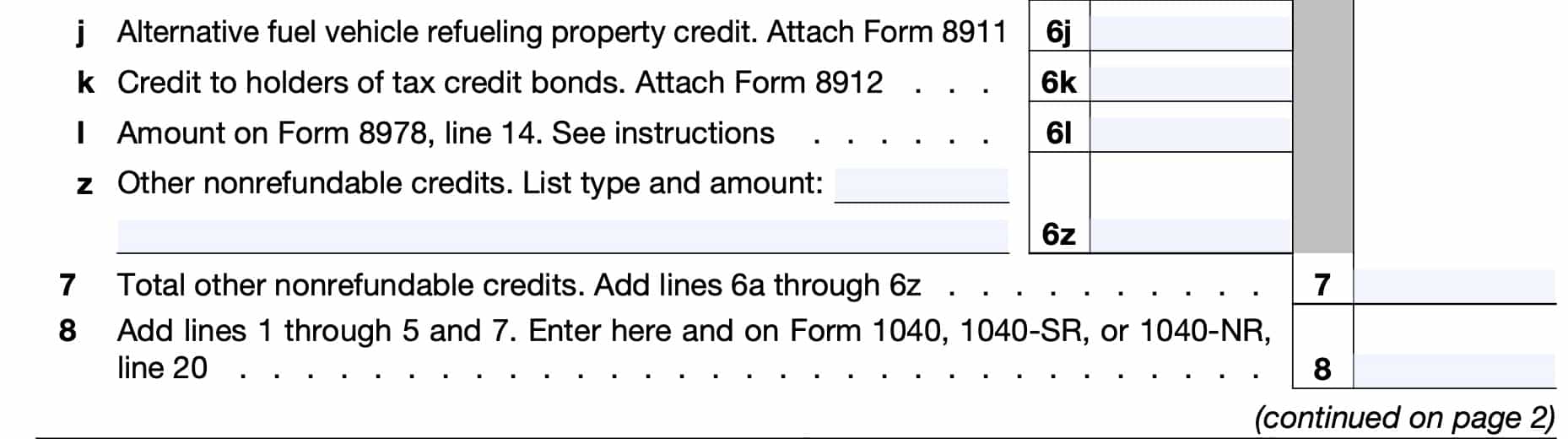

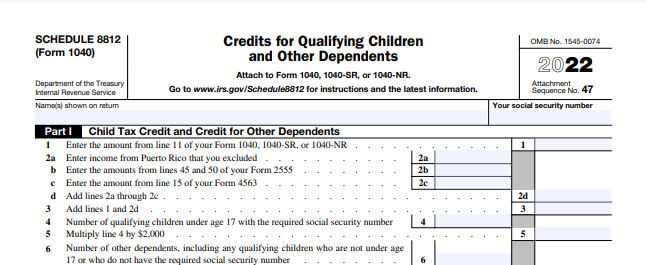

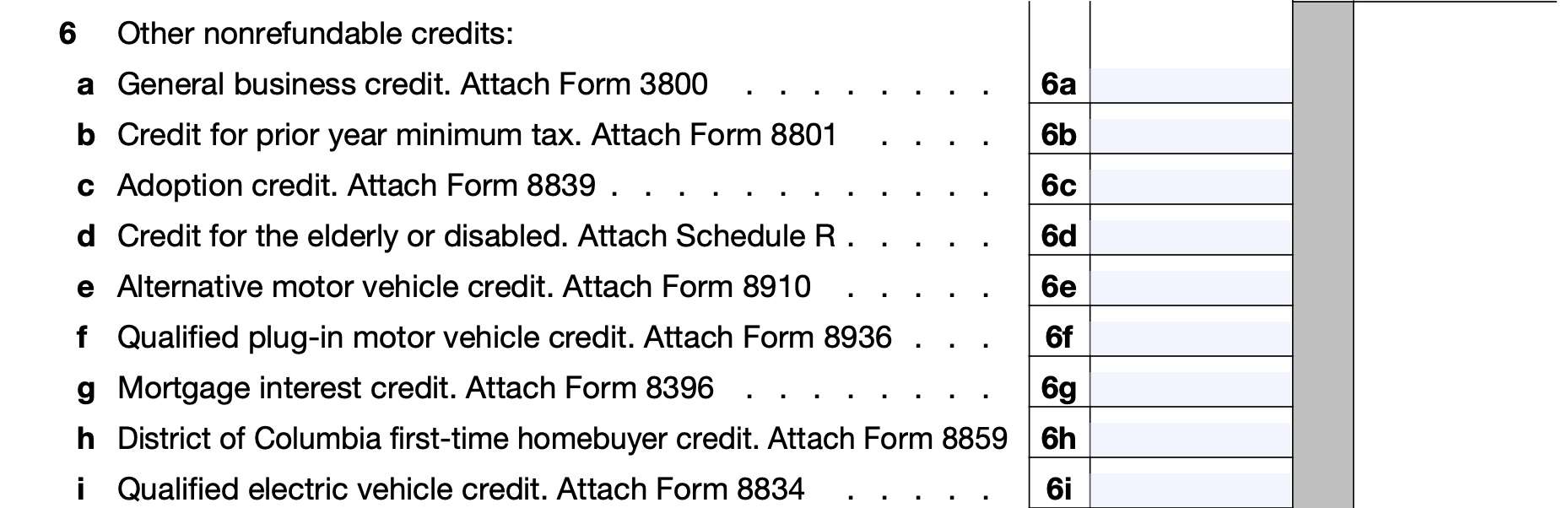

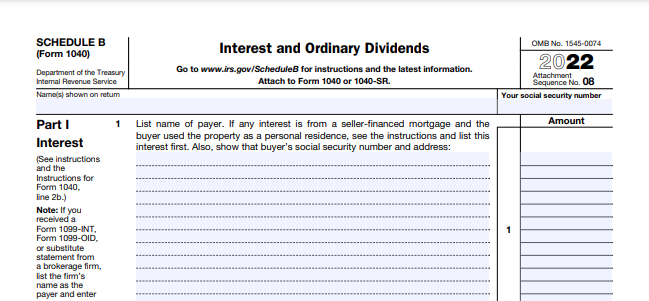

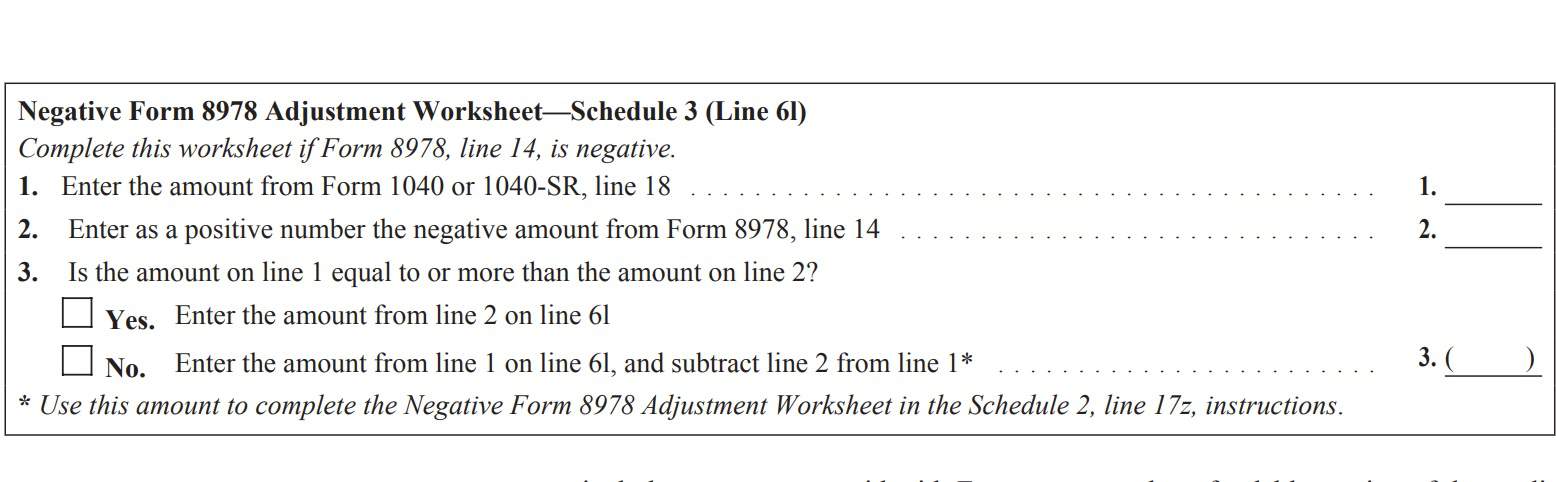

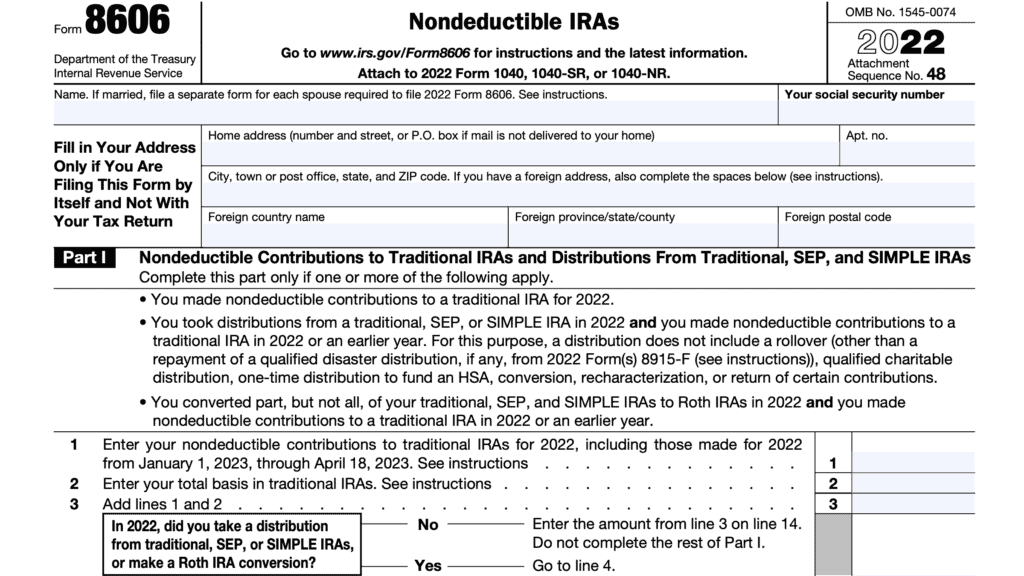

The newly revised Schedule 3 will be attached to the 1040 Form or the new 1040 SR Form if entries are made on Schedule 3 which include Nonrefundable Credits Schedule 3 is necessary for taxpayers who are eligible for specific tax credits or need to report certain types of payments. This includes ...

IRS Schedule 3 walkthrough Additional Credits Payments

What is IRS Form 1040 Schedule 3?

Schedule 3 Line 15Schedule 3 is a supplemental form associated with Form 1040 that U.S. taxpayers use to report non-refundable tax credits beyond the basic child tax credit or ... Part I of Form 1040 Schedule 3 is for nonrefundable credits including the Foreign Tax Credit Child and Dependent Care Credit education

Claim an additional exemption for each dependent child. • who is a son, stepson, daughter, stepdaughter and/or foster child,. IRS Schedule 3 Instructions - Additional Credits & Payments How to Quickly Fill Out Form 1040 Schedule 3

Understanding IRS Form 1040 Schedule 3 Additional Credits and

IRS Schedule 3 Instructions - Additional Credits & Payments

Schedule 3 should be used when claiming additional credits and payments during your tax return process If you are eligible for various tax credits this form IRS Schedule 3 Instructions - Additional Credits & Payments

It is used to report various tax credits and payments that can potentially reduce your overall tax liability or increase the amount of your tax refund Schedule 3 Nonrefundable Credits to Know | Credit Karma What is IRS Form 1040 Schedule 3? - TurboTax Tax Tips & Videos

Describes new Form 1040, Schedules & Tax Tables

IRS Schedule 3 Instructions - Additional Credits & Payments

What is IRS Form 1040 Schedule 3?

IRS Schedule 3 Instructions - Additional Credits & Payments

IRS Form 1040 Schedule 3 - Intro to the Different Fields - YouTube

What is IRS Form 1040 Schedule 3?

IRS Schedule 3 Instructions - Additional Credits & Payments

IRS Schedule 3 Instructions - Additional Credits & Payments

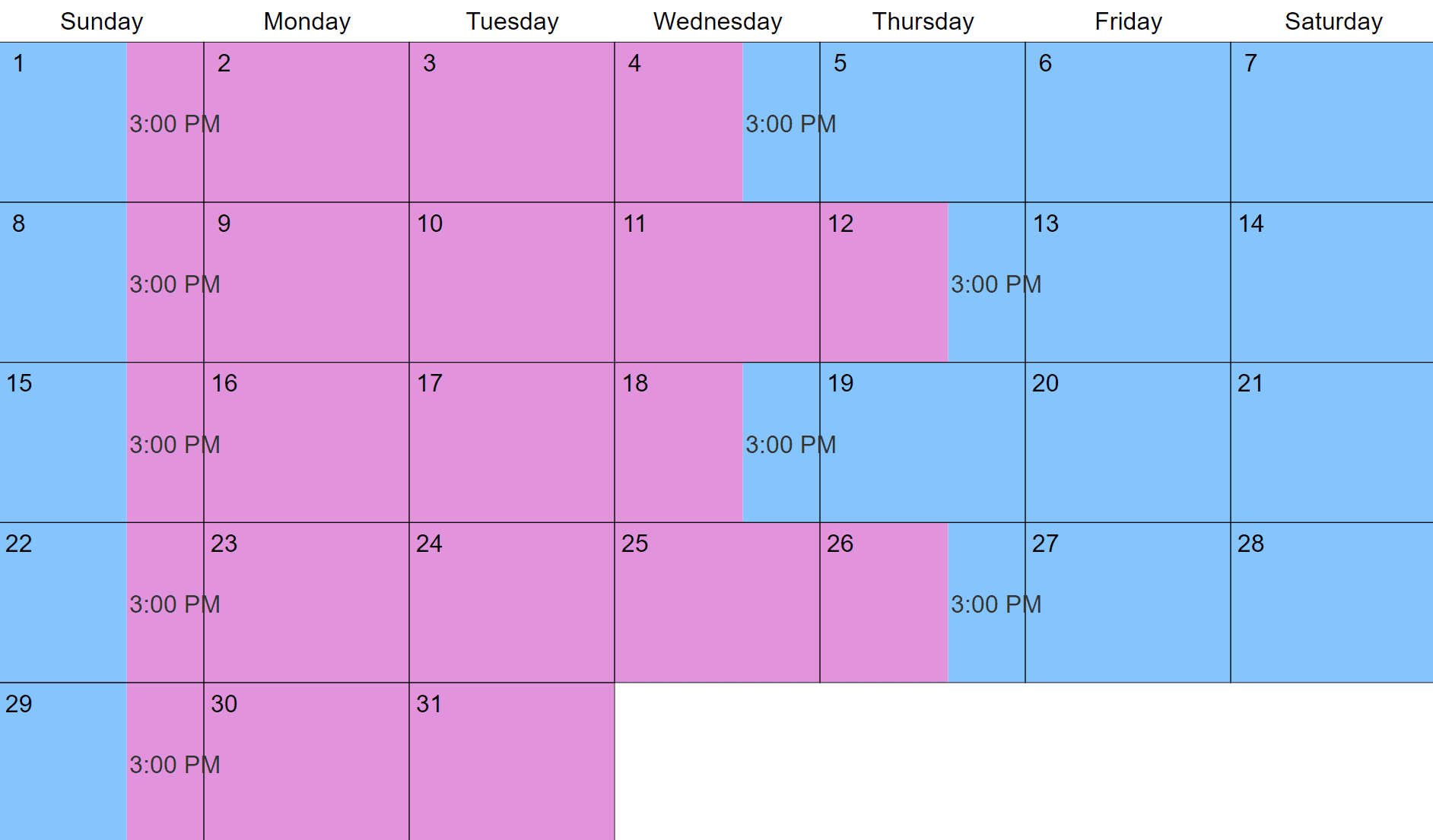

3-4-4-3 Visitation Schedules: Examples & Variations, Pros & Cons

IRS Schedule 3 Instructions - Additional Credits & Payments