Schedule C Codes - Organizing your daily jobs becomes simple and easy with free printable schedules! Whether you need a planner for work, school, or individual activities, these templates provide a practical way to remain on top of your responsibilities. Designed for versatility, printable schedules are readily available in different formats, consisting of everyday, weekly, and monthly layouts. You can easily personalize them to fit your requirements, ensuring your productivity skyrockets while keeping everything in order. Most importantly, they're free and available, making it basic to plan ahead without breaking the bank.

From handling consultations to tracking goals, Schedule C Codes are a lifesaver for anybody juggling multiple priorities. They are perfect for students handling coursework, professionals coordinating meetings, or households balancing hectic routines. Download, print, and begin planning immediately! With a wide variety of styles available online, you'll discover the ideal template to match your style and organizational requirements.

Schedule C Codes

Schedule C Codes

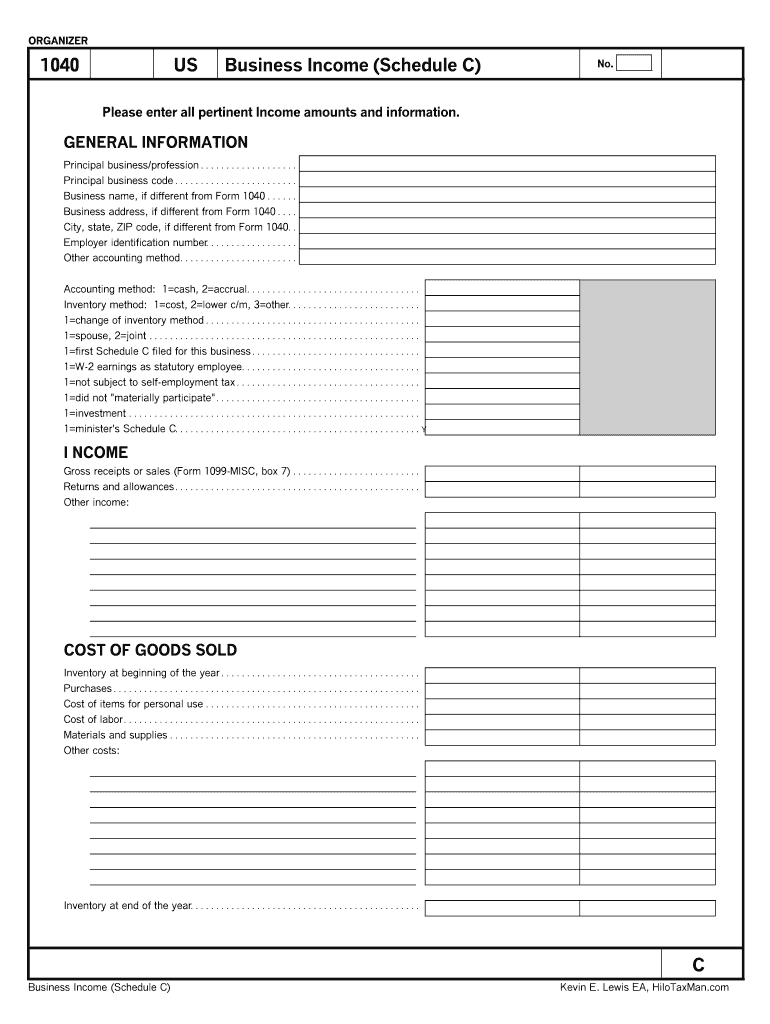

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor About the Form 5500. The Form 5500, Annual Return/Report of Employee Benefit. Plan, including all required schedules and attachments (Form.

Schedule C Business Activity Codes TaxAct

![Your Guide to Business Codes for Income Taxes [Updated for 2023 + Printable Guide] your-guide-to-business-codes-for-income-taxes-updated-for-2023-printable-guide](https://cdn.prod.website-files.com/5cdcb07b95678db167f2bd86/6477d5cc9b6a3efa0e4d2a61_business-code-for-taxes-schedule-c.png)

Your Guide to Business Codes for Income Taxes [Updated for 2023 + Printable Guide]

Schedule C CodesCode Service/Compensation. 10. Accounting (including auditing). 11. Actuarial. 12. Claims processing. 13. Contract Administrator. 14. Plan Administrator. 15. These six digit codes are based on the North American Industry Classification System NAICS Select the category that best describes your primary business

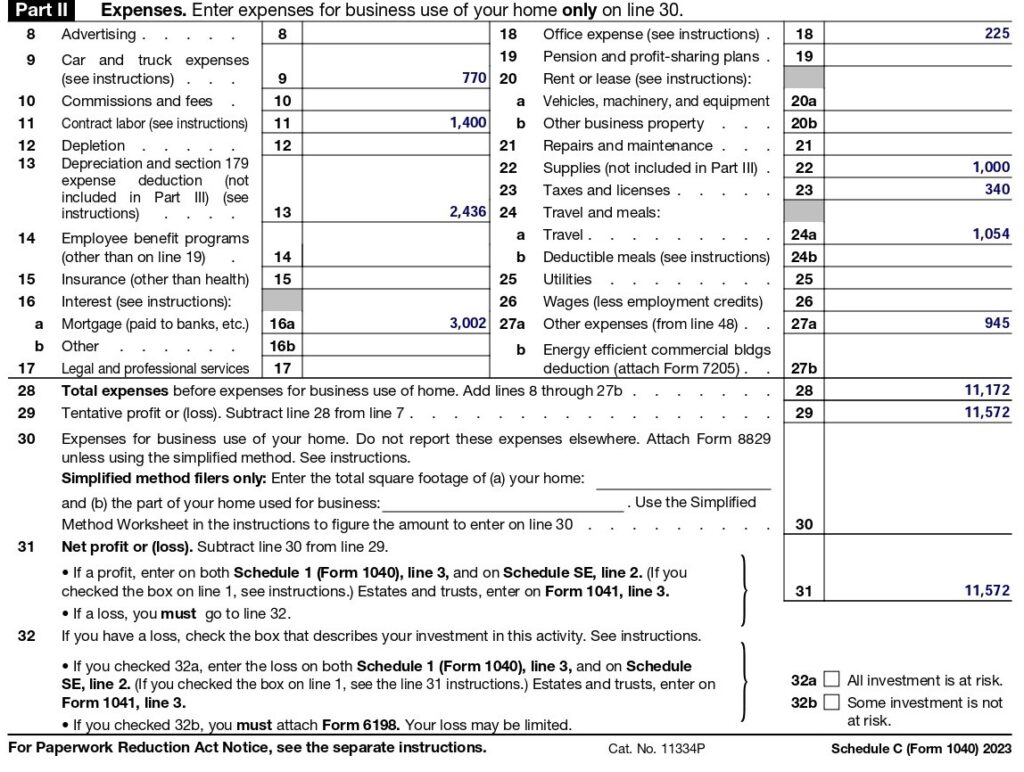

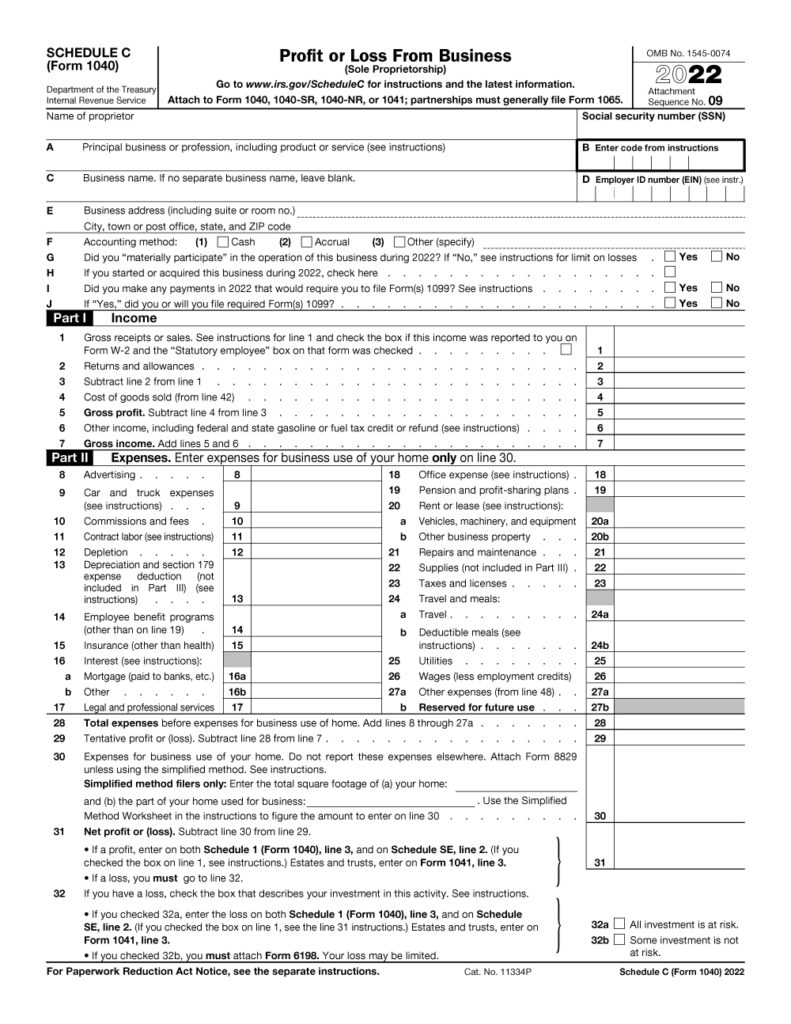

IRS Schedule C, Profit or Loss from Business, is a tax form you file with your Form 1040 to report income and expenses for your business. How to fill out Schedule C : Stripe: Help & Support How to Complete 2019 Schedule C Form 1040 - Line A to J - YouTube

Instructions for Form 5500 U S Department of Labor

What is an IRS Schedule C Form?

To enter a principal business or professional activity code for a Schedule C on the C screen use the Business code drop list Free 2022 IRS Schedule C Instructions for Profit or Loss | PrintFriendly

Business Codes for Schedule C 722511 Full service restaurants 722513 Limited service restaurants 722515 Snack non alcoholic beverage bars 722300 Solved SCHEDULE C (Form 1040) Profit or Loss From Business | Chegg.com How to Fill out Schedule C Form 1040 – Sole Proprietorship Taxes - YouTube

How to Fill Out Your Schedule C Perfectly (With Examples!)

Schedule C (Form 1040) 2023 Instructions

How To Fill Out Schedule C (With Example)

Schedule C (Form 1040) 2023 Instructions

Schedule C Business Codes - Fill Online, Printable, Fillable, Blank | pdfFiller

How to Fill Out Your Schedule C Perfectly (With Examples!)

Schedule C: Tax Form for Self-Employed Individuals - FreshBooks

Free 2022 IRS Schedule C Instructions for Profit or Loss | PrintFriendly

How to fill out Schedule C : Stripe: Help & Support

What should I put into the blank next to Schedule C in Box 1 of the Non-Employee Compensation Worksheet?