Schedule F Instructions - Organizing your daily jobs ends up being simple and easy with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates use a practical way to stay on top of your obligations. Designed for versatility, printable schedules are offered in numerous formats, including daily, weekly, and monthly designs. You can quickly customize them to match your requirements, guaranteeing your efficiency skyrockets while keeping whatever in order. Most importantly, they're free and accessible, making it simple to prepare ahead without breaking the bank.

From handling consultations to tracking objectives, Schedule F Instructions are a lifesaver for anybody juggling multiple priorities. They are perfect for students handling coursework, specialists coordinating conferences, or households balancing busy routines. Download, print, and begin planning right away! With a vast array of styles available online, you'll find the ideal template to match your style and organizational needs.

Schedule F Instructions

Schedule F Instructions

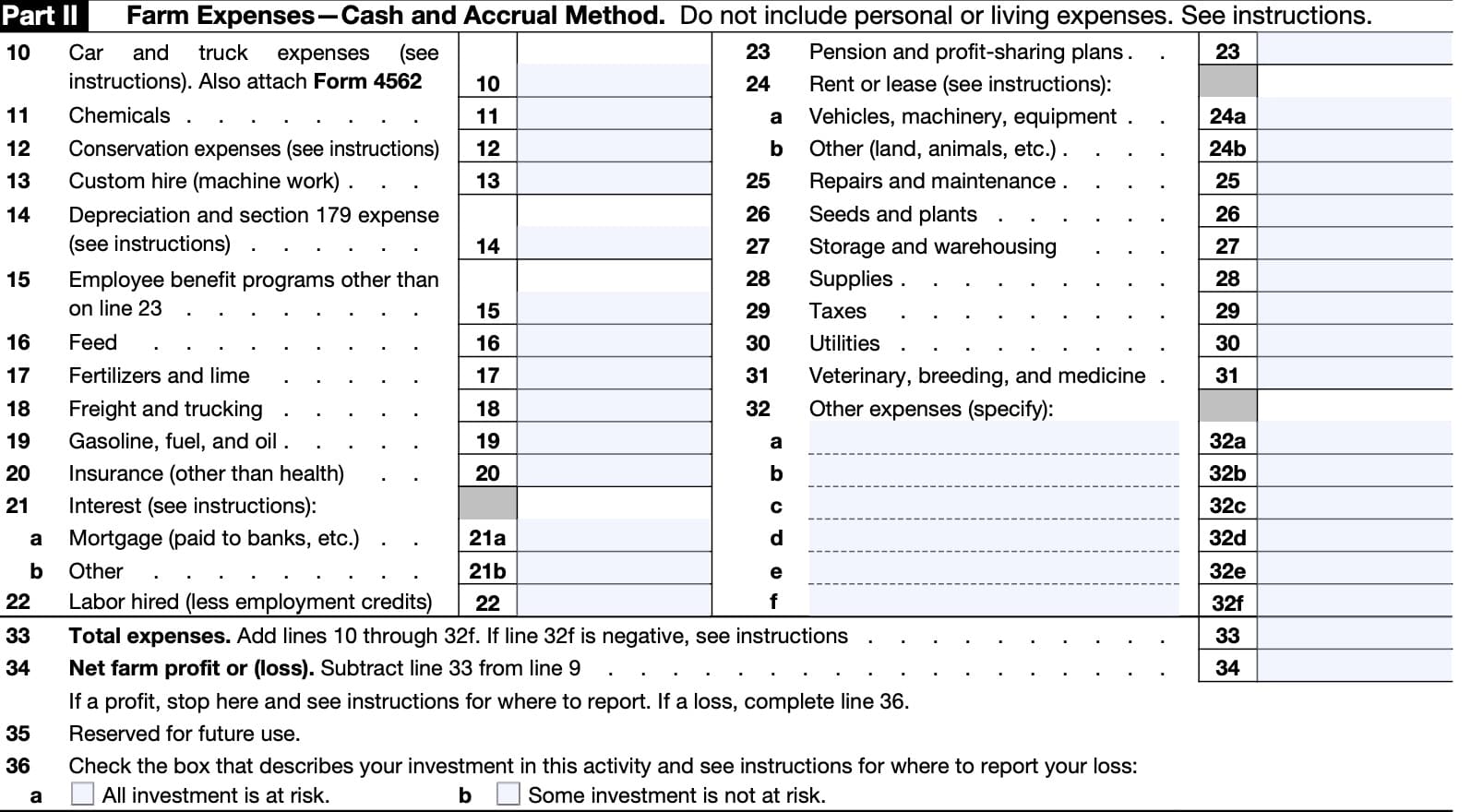

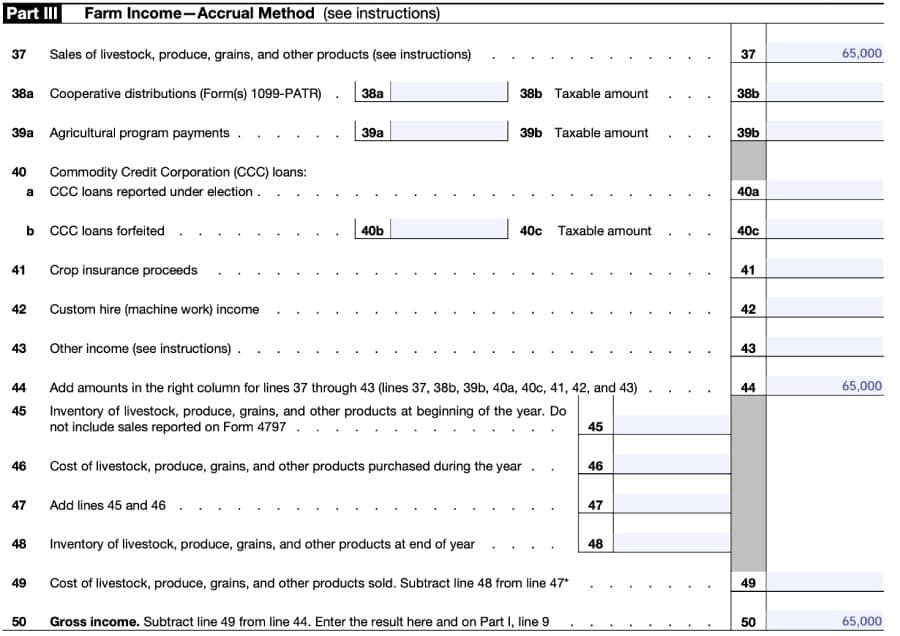

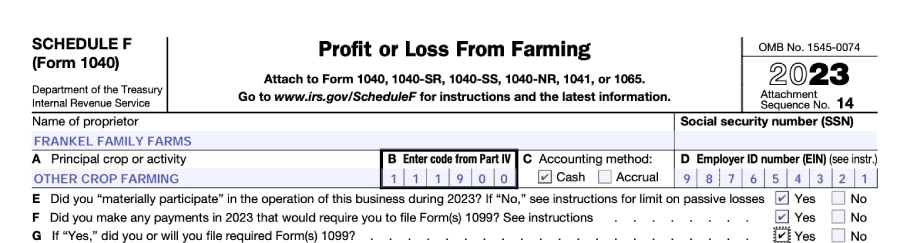

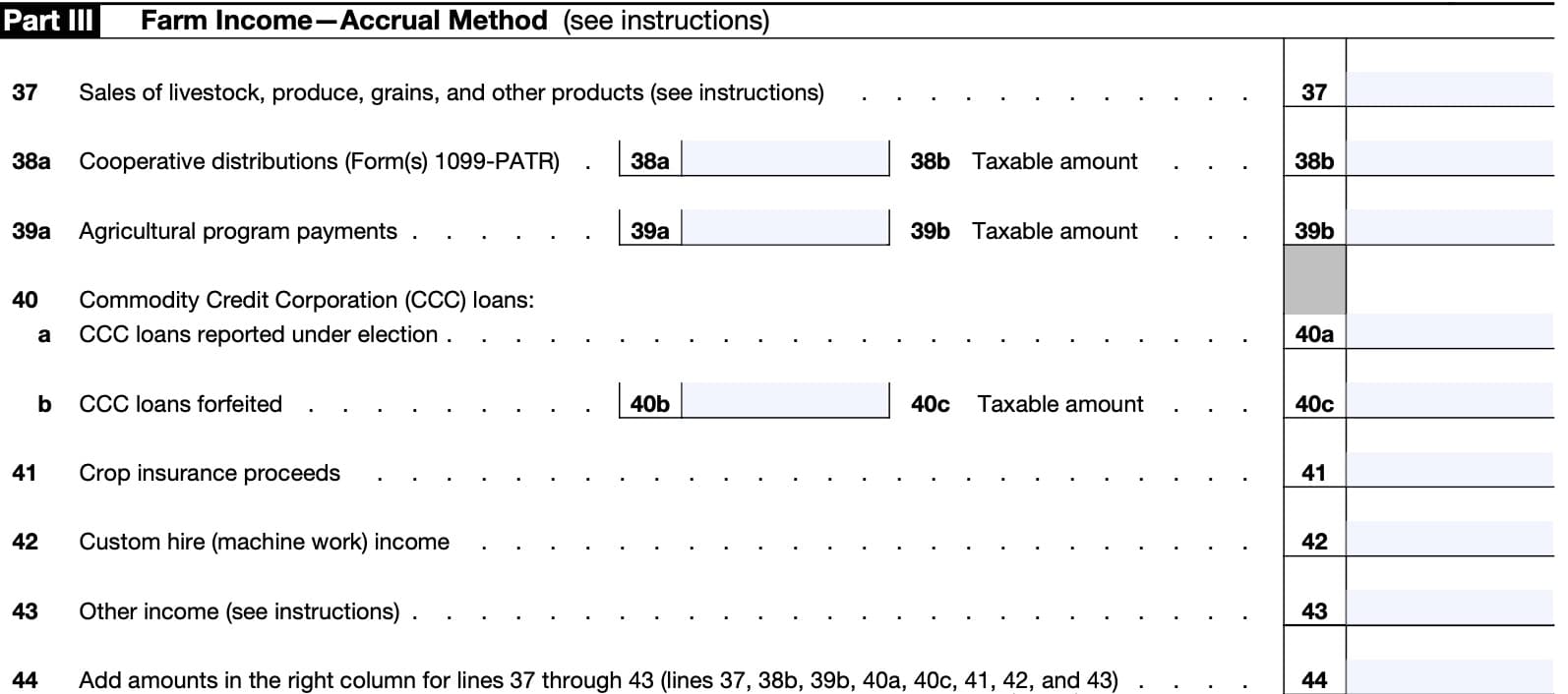

We dissect the Schedule F form with line by line help for a stress free filing Understand every detail so you can properly file your taxes Schedule F Instructions. Schedule F is comprised of four key parts: Part I. Farm Income – Cash Method; Part II. Farm Expenses – Cash and Accrual Method; Part ...

IL 1041 Schedule F Instructions Illinois Department of Revenue

I've Been a Family Farmer for 30 Years. Here's My IRS Schedule F. | Civil Eats

Schedule F InstructionsThis form helps calculate the taxable income from farming activities, which is then transferred to Form 1040 for total tax liability. For farmers, Schedule F ... More In Forms and Instructions Use Schedule F Form 1040 to report farm income and expenses Current revision Schedule F Form 1040 PDF

The instructions for Schedule F have a more complete list these types of income streams which are best reported on Line 8 of Schedule F. Example 1. Bill ... Agricultural Taxes - YouTube Schedule F (Form 1040): Profit or Loss From Farming

IRS Schedule F Reporting Farming Income Community Tax

IRS Schedule F walkthrough (Profit or Loss From Farming) - YouTube

Schedule F is an IRS form that allows farmers to report their income and expenses related to farming operations It is used by individuals partnerships Filing Schedule F for Farmers: Step-by-Step Guide & Errors to Avoid

Frequently farmers will help neighbors and be paid for that help This is custom work or machine hire income which is reported on Line 7 of Schedule F As a The Dangers of Schedule F 2024 Schedule J Form and Instructions (Form 1040)

IRS Schedule F Instructions - Reporting Farming Profit or Loss

How to Fill Out Schedule F in 2024 (With Example)

Determining Schedule F Income in FINPACK - FINPACK

U.S. Individual Income Tax Return

2010 Instruction 1040 Schedule F

How to Fill Out Schedule F in 2024 (With Example)

IRS Schedule F Instructions - Reporting Farming Profit or Loss

Filing Schedule F for Farmers: Step-by-Step Guide & Errors to Avoid

2023 Schedule F (Form 990)

Schedule F: Demystifying Schedule F: Understanding IRS Pub 225 - FasterCapital