Schedule G In 1120 - Organizing your everyday tasks ends up being effortless with free printable schedules! Whether you require a planner for work, school, or individual activities, these templates offer a convenient way to stay on top of your responsibilities. Designed for flexibility, printable schedules are available in numerous formats, consisting of everyday, weekly, and monthly layouts. You can easily tailor them to fit your requirements, ensuring your productivity skyrockets while keeping everything in order. Most importantly, they're free and accessible, making it easy to prepare ahead without breaking the bank.

From managing consultations to tracking objectives, Schedule G In 1120 are a lifesaver for anybody juggling multiple priorities. They are ideal for trainees handling coursework, professionals coordinating conferences, or families stabilizing hectic routines. Download, print, and begin preparing right away! With a vast array of designs available online, you'll discover the perfect template to match your style and organizational needs.

Schedule G In 1120

Schedule G In 1120

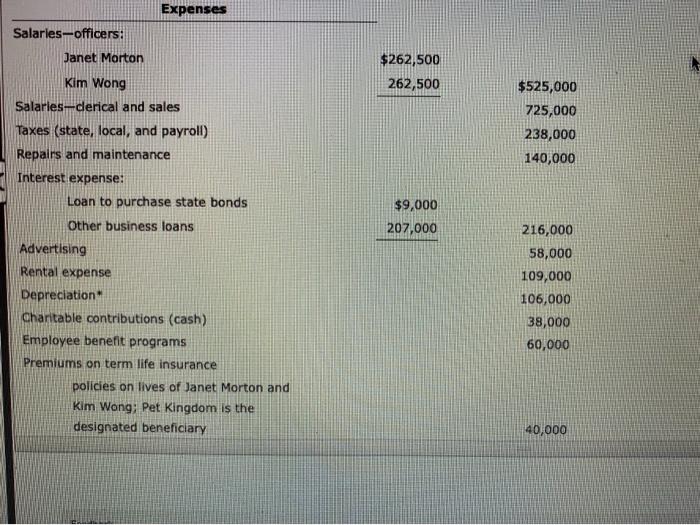

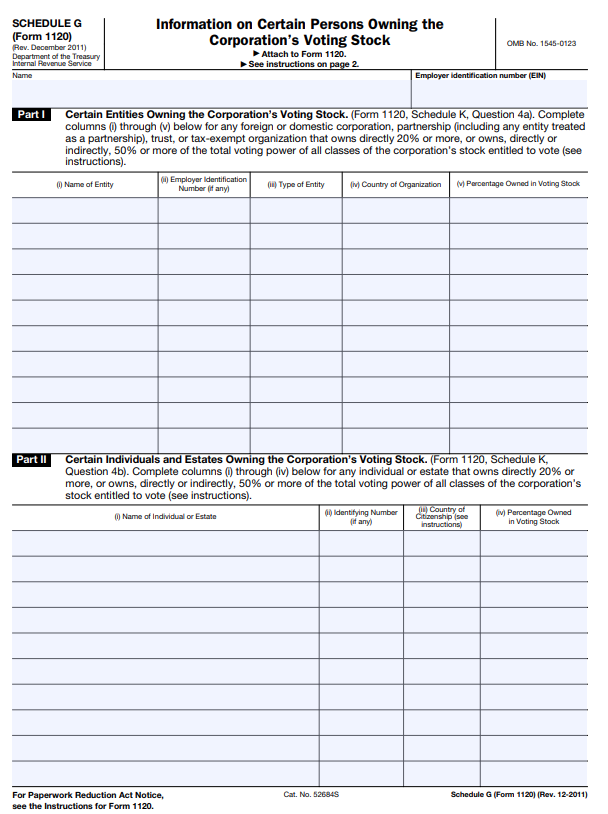

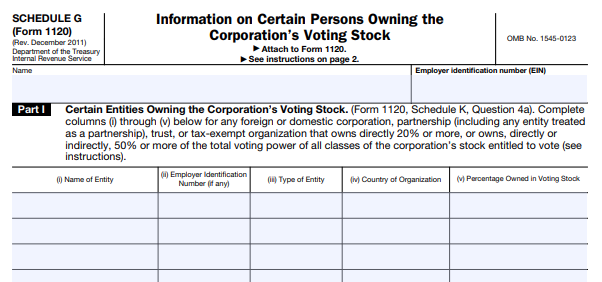

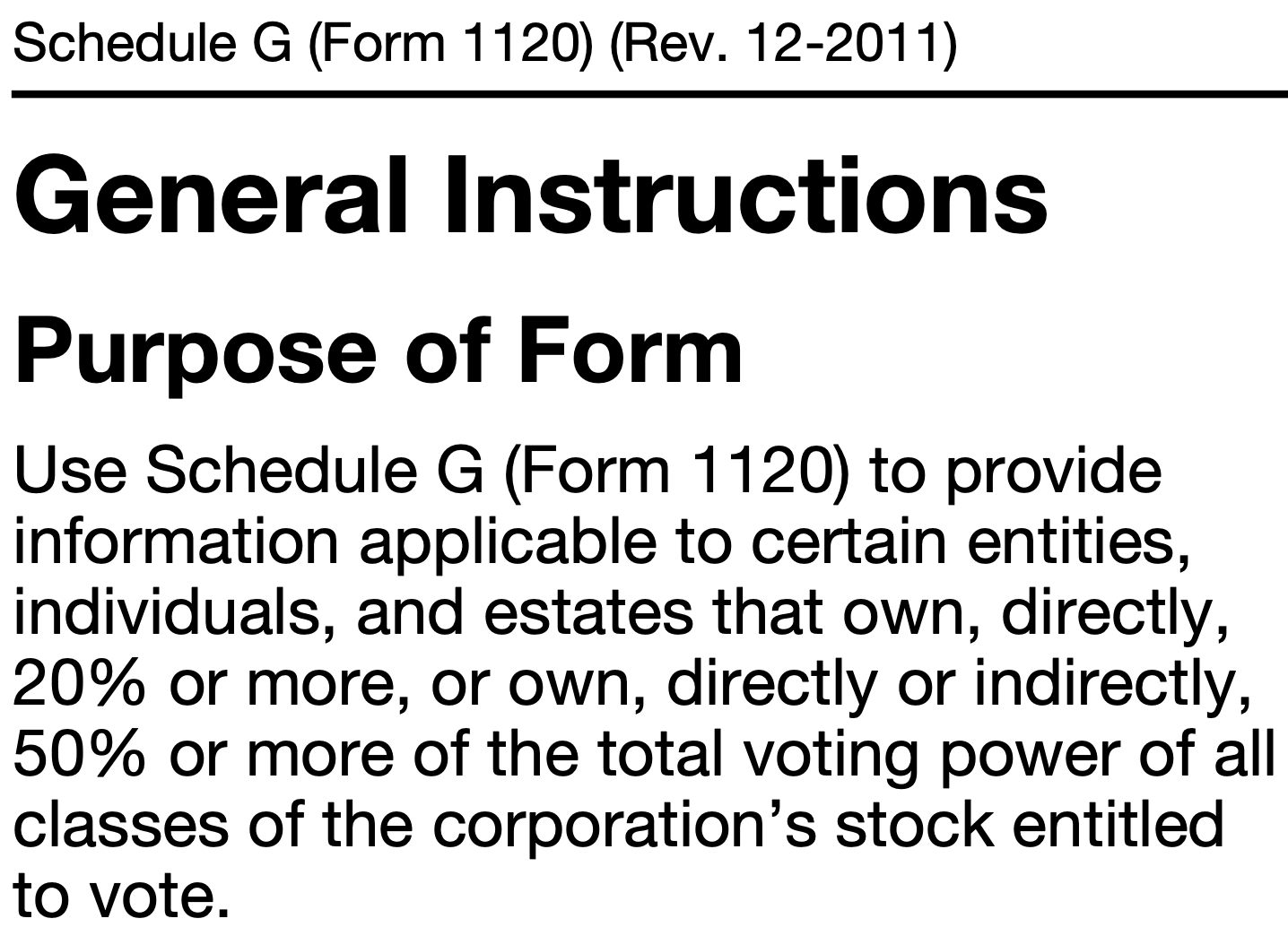

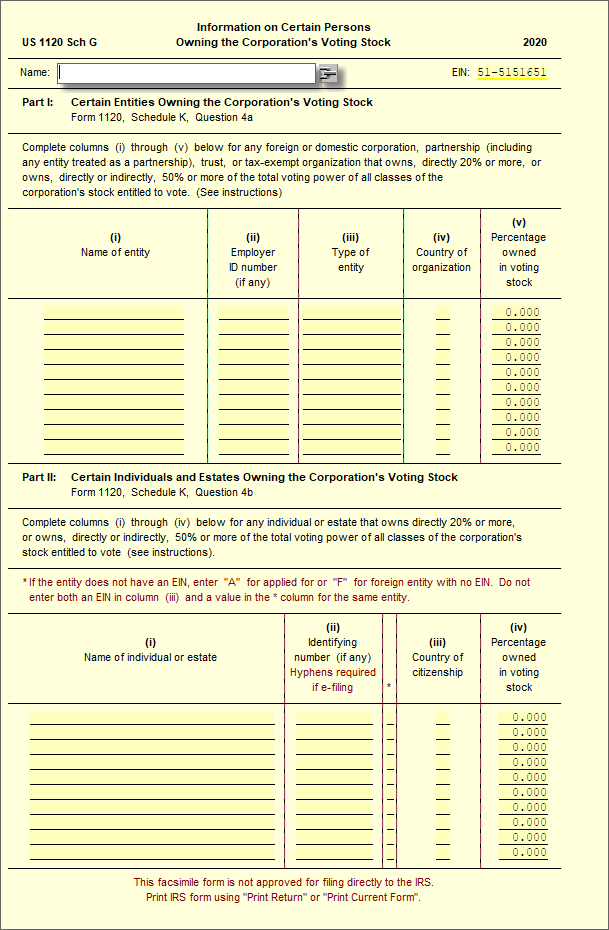

It helps capture information related to parent subsidiary structures brother sister relationships and other affiliations Schedule G (Form 1120) is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, ...

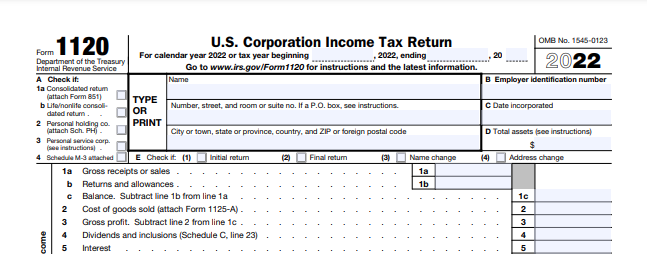

Form 1120 C Schedule G calculation Thomson Reuters

What is IRS Form 1120 Schedule G?

Schedule G In 1120Use Schedule G (Form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, ... Use Schedule G Form 1120 to provide information applicable to certain entities individuals and estates that own directly 20 or more or own directly or

Schedule G (Form 1120) is an IRS form that requires corporations to report certain information on shareholders owning the corporation's voting stock. Form 1120 Filing Guide: Corporate Tax Return & Schedules Explained Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 Click here to watch full video: https://www.youtube.com/watch?v=_OV1KAfs21U #ScheduleG1120 #TaxPlanningTips #MeruAccounting #TaxCompliance

Schedule G Form 1120 Accessible Fill and sign online with Lumin

What is IRS Form 1120 Schedule G?

Schedule G is prepared when the cooperative s total receipts or assets at the end of the year are 250 000 or more You may force or prevent the preparation Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 Click here to watch full video: https://www.youtube.com/watch?v=_OV1KAfs21U #ScheduleG1120 #TaxPlanningTips #MeruAccounting #TaxCompliance

IRS Form 1120 Schedule G is used to provide information applicable to certain entities individuals and estates that own directly 20 or more or own Schedule G: Owners of Corporation's Voting Stock — Vintti What is IRS Form 1120 Schedule G?

How to Fill Out Form 1120 Schedule G: A Guide for Startup Founders

Sch G (1120) - Information on Persons Owning Voting Stock – UltimateTax Solution Center

Schedule G Form ≡ Fill Out Printable PDF Forms Online

Form 1120 Schedule G - Persons Owning Corporation Stock - YouTube

Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 - YouTube

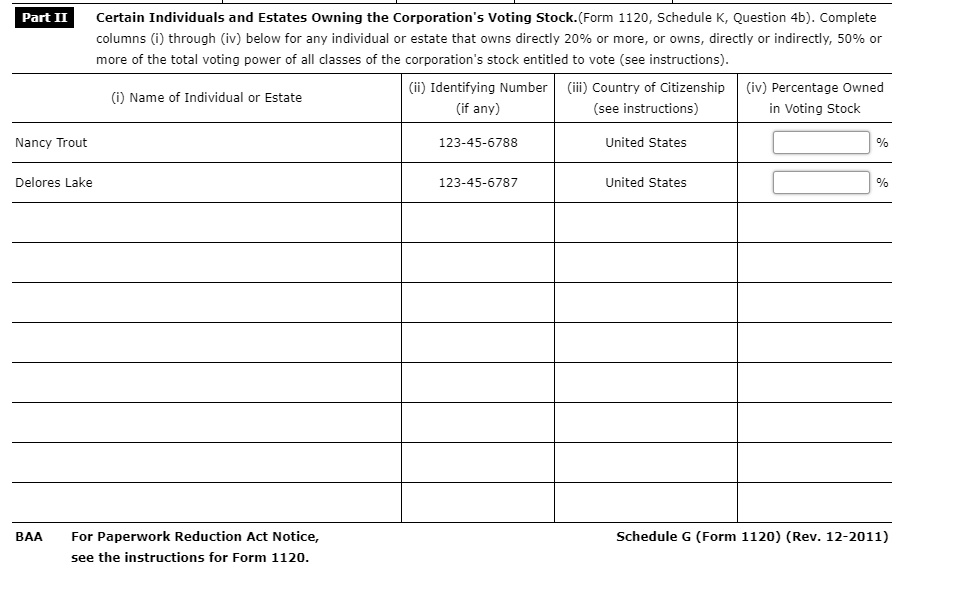

Note: This problem is for the 2018 tax year. On | Chegg.com

Schedule G (Form 1120) Accessible | Fill and sign online with Lumin

Why Schedule G 1120 Matters: Essential Tax Insights! | Schedule G 1120 Click here to watch full video: https://www.youtube.com/watch?v=_OV1KAfs21U #ScheduleG1120 #TaxPlanningTips #MeruAccounting #TaxCompliance

Schedule J 'Tax computation and Payment' on Form 1120 for tax years before the Tax Cuts and Jobs Act - YouTube

Solved Instructions Form 1120, pages 1, 2 and 3 Form 1120, | Chegg.com