Schedule K 1 Form 1120s - Organizing your everyday tasks becomes effortless with free printable schedules! Whether you need a planner for work, school, or individual activities, these templates offer a practical method to remain on top of your obligations. Developed for versatility, printable schedules are readily available in various formats, consisting of everyday, weekly, and monthly designs. You can quickly tailor them to suit your needs, guaranteeing your efficiency skyrockets while keeping everything in order. Best of all, they're free and available, making it basic to plan ahead without breaking the bank.

From handling consultations to tracking goals, Schedule K 1 Form 1120s are a lifesaver for anyone balancing multiple concerns. They are perfect for trainees handling coursework, specialists coordinating conferences, or households balancing hectic routines. Download, print, and begin planning right away! With a large range of designs readily available online, you'll find the best template to match your design and organizational requirements.

Schedule K 1 Form 1120s

Schedule K 1 Form 1120s

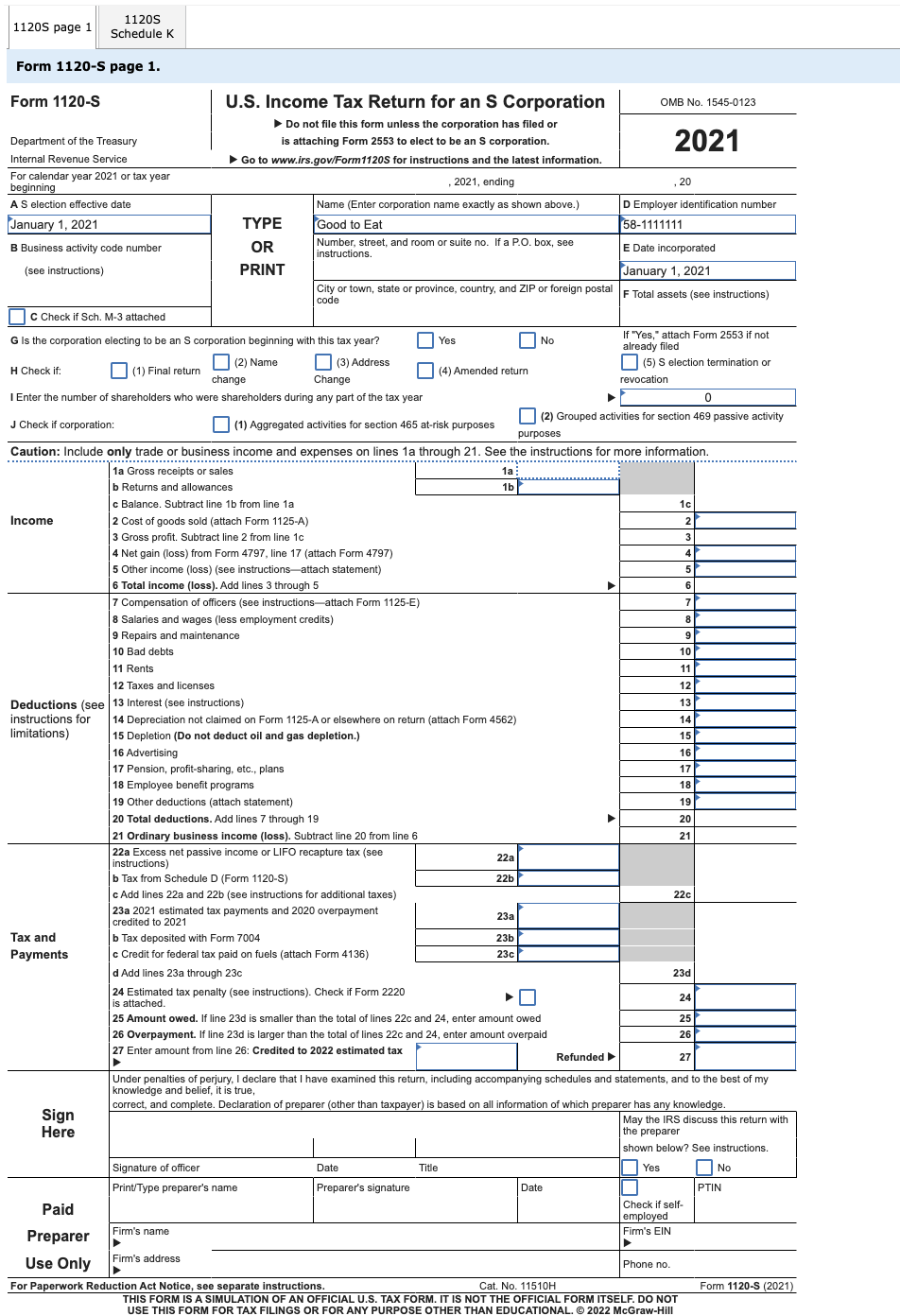

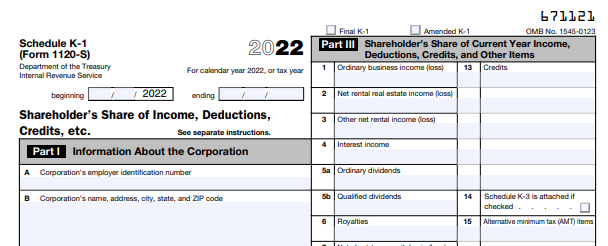

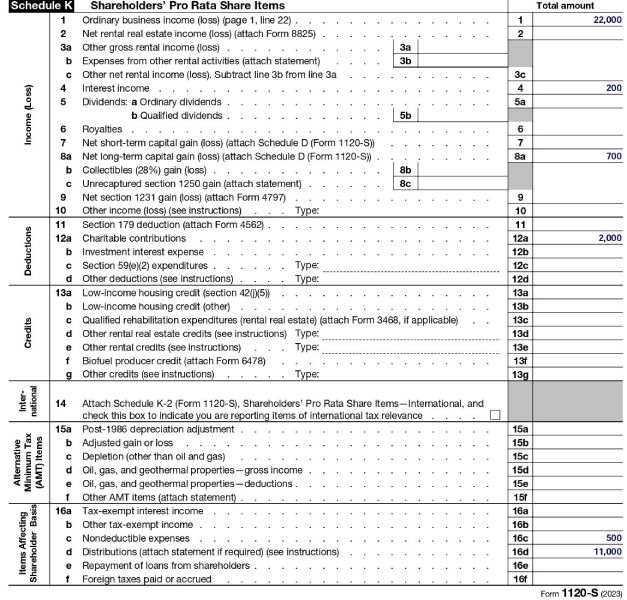

Schedule K 1 records each owners share of the business s income deductions credits and other financial items The corporation submits a copy It reports each shareholder's share of income, losses, deductions, and credits. The corporation reports these to the IRS on Form 1120S. Some ...

Schedule K 1 Form 1120 S Entering in Program TaxAct

How To Complete Form 1120S & Schedule K-1 (+Free Checklist)

Schedule K 1 Form 1120sSchedule K-1 (Form 1120S or Form 1065). Lines 1 through 3—Enter on federal Schedule E using Kentucky amounts or on Form 8582-K, if applicable. Line 4(a) ... The corporation uses Schedule K 1 to report your share of the corporation s income deductions credits and other items Keep it for your records Don t file

IRS Schedule K-1 is a document used to describe the incomes, losses, and dividends of a business's partners or an S corporation's shareholders. Schedule K-1 Form 1120-S: Guide for S corp owners Form 1120S Schedule K Instructions

What is a Schedule K 1 Tax Form TurboTax Intuit

How to Fill Out Schedule K-1 Form 1120 S - YouTube

Along with other IRS forms this one is usually submitted with copies of Schedule K 1 Form 1120 S to specify what income deductions credits and other items Schedule K-3 (Form 1120-S) | Fill and sign online with Lumin

The 2024 Schedule K 1 form must report the entity s income deductions credits and other tax attributes allocated to each partner shareholder or beneficiary S Corp Schedule K-1 (Form 1120S): A Simple Guide | Bench Accounting Form 1120-S Instructions: U.S. Return of Partnership Income

Free 2021 Shareholder Instructions for Schedule K-1 Form 1120-S | PrintFriendly

What Is a K1 Form | What Is It Used For, When Is It Needed, and How to Fill Out a Schedule K1

2023 IRS Form 1120-S Schedule K-1 Walkthrough - YouTube

1120s k 1: Fill out & sign online | DocHub

IRS Schedule K-1 Form 1120-S ≡ Fill Out Printable PDF Forms Online

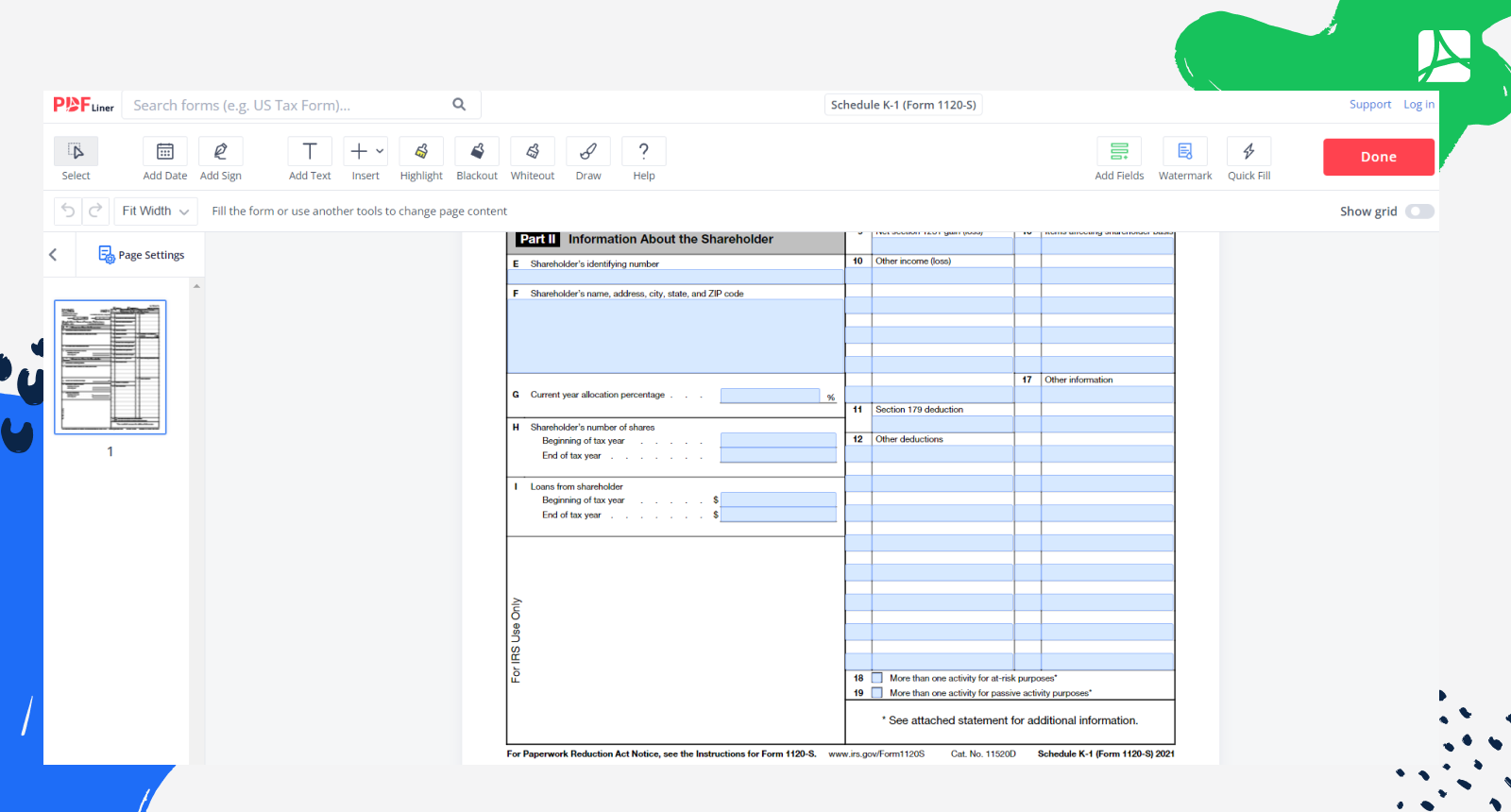

Schedule K-1 (Form 1120-S): Print and sign form online | PDFliner

1120S page 1 Schedule K 1120 S Form 1120-S page 1. | Chegg.com

Schedule K-3 (Form 1120-S) | Fill and sign online with Lumin

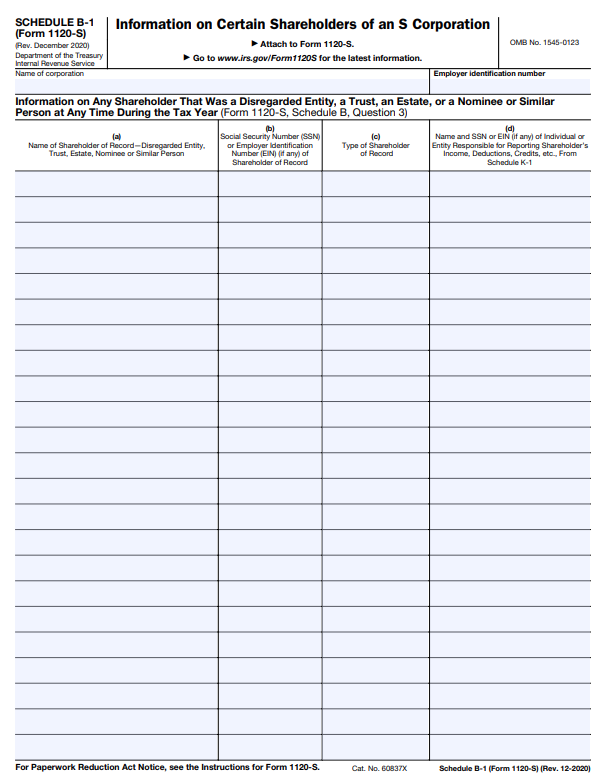

What is IRS Form 1120S Schedule B-1?

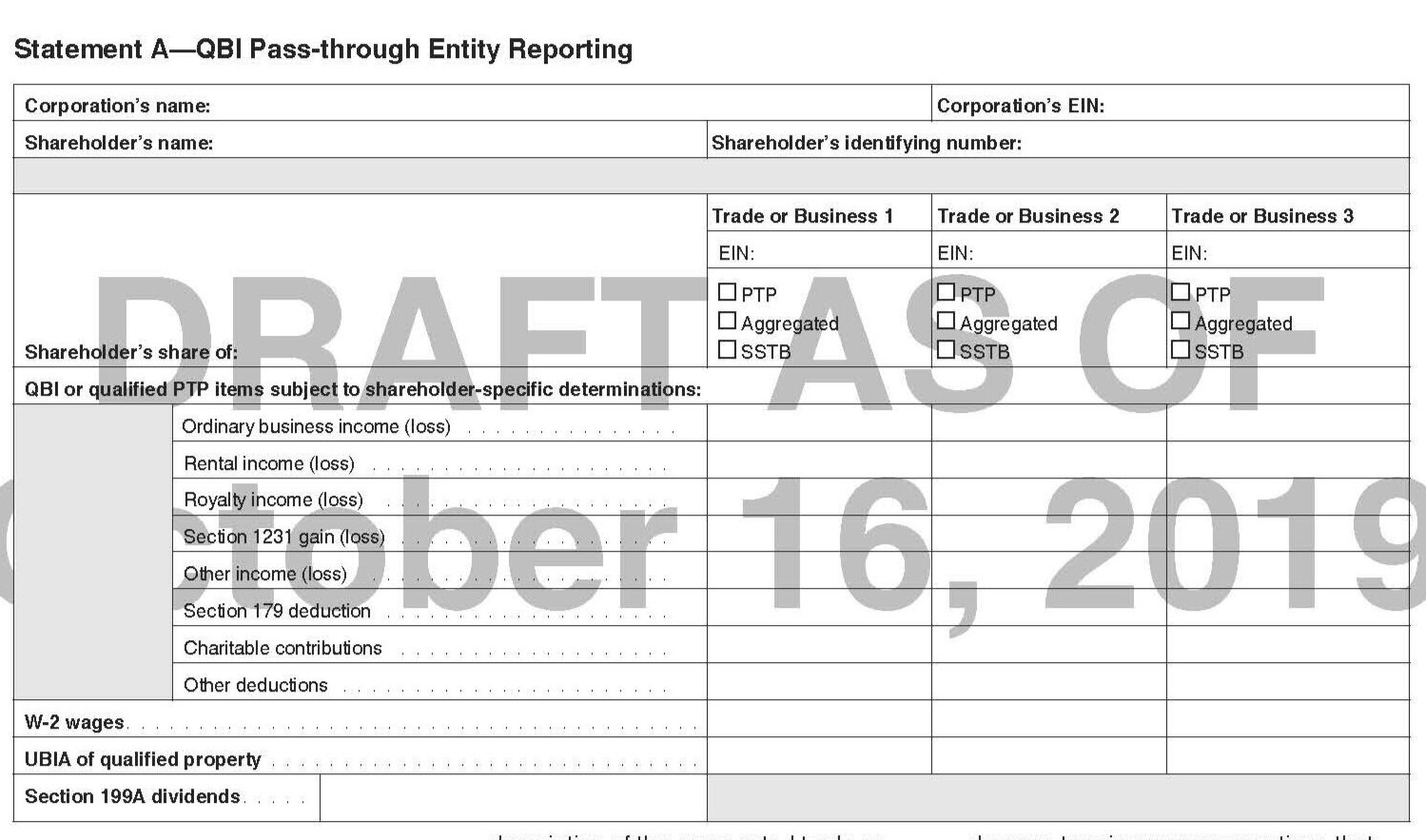

Draft 2019 Form 1120-S Instructions Adds New K-1 Statements for §199A — Current Federal Tax Developments