Schedule M 3 - Organizing your daily jobs ends up being uncomplicated with free printable schedules! Whether you need a planner for work, school, or personal activities, these templates provide a hassle-free way to stay on top of your obligations. Developed for flexibility, printable schedules are offered in various formats, consisting of daily, weekly, and monthly designs. You can easily customize them to match your needs, ensuring your performance skyrockets while keeping everything in order. Best of all, they're free and available, making it easy to plan ahead without breaking the bank.

From handling appointments to tracking objectives, Schedule M 3 are a lifesaver for anyone balancing numerous priorities. They are perfect for students managing coursework, specialists coordinating meetings, or families balancing hectic routines. Download, print, and begin planning right away! With a wide variety of styles offered online, you'll find the ideal template to match your style and organizational requirements.

Schedule M 3

Schedule M 3

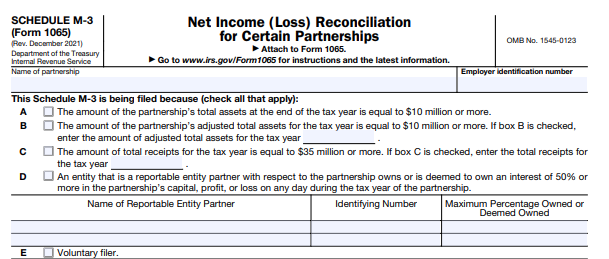

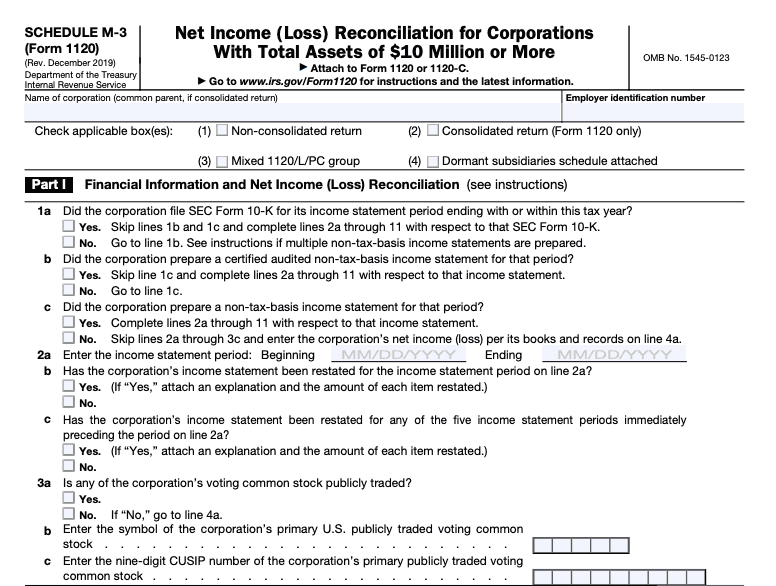

Purpose of Schedule group in order to determine if the group consolidated tax group files Form 1120 Schedule M 3 Part I asks certain Form 1120 Schedule M-3 FAQs on this page are organized to correspond with sections and line items described in the instructions for Schedule M-3.

Schedule M 3 Form 1120 Who Must File TaxAct

Schedule M-3 (Form 1120-S) | Fill and sign online with Lumin

Schedule M 3Complete Schedule M-3. Enter the book amounts for calculation. Use Ptr Alloc in the M3-2 and M3-3 screens to allocate these amounts to partners. Schedule M 3 Part I asks certain questions about the partnership s financial statements and reconciles financial statement net income loss

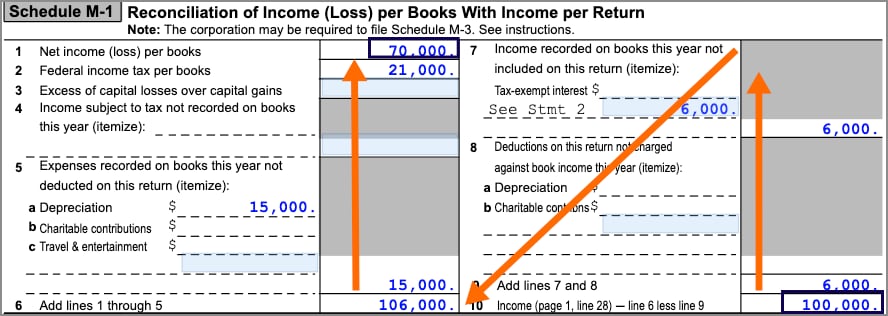

Learn about IRS Form 1120 Schedule M-3, a tax form used by corporations to reconcile net income or loss. Stay compliant with your taxes effortlessly with ... Solved Prepare a Schedule M-1, page 5, Form | Chegg.com Example #3 –Schedule M-3 Detail

IRS Issues FAQs for Form 1120 Schedule M 3 Tax Notes

Example #3 –Schedule M-3 Detail

Filing Schedule M 3The amount of total assets at the end of the tax year reported on Schedule L is greater than or equal to 10 million The amount of How are retained earnings calculated on Form 1120 in ProConnect Tax

The Schedule M 3 requires companies to expose the types of adjustments they re making to book numbers to arrive at taxable income Schedule M 3 form 1120 Exaplined - YouTube Drake Tax - 1120: Calculating Book Income, Schedule M-1 and M-3

SOLUTION: Schedule M 3 Completed 1 - Studypool

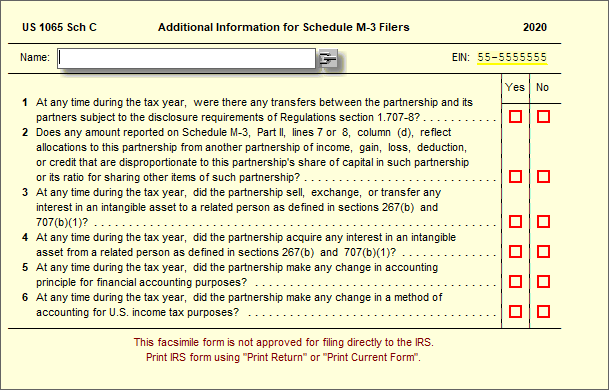

Sch C (1065) - Additional Information for Schedule M-3 Filers – UltimateTax Solution Center

Example #3 –Schedule M-3 Detail

Schedule M-3 Form 1065 Explained - YouTube

Free Instructions for Schedule M-3 Form 1120 | PrintFriendly

Reporting Permanent vs. Temporary Differences for Schedule M-1 & M-3 - Lesson | Study.com

Form 1120s Instructions - How to File S Corp Taxes & Maximize Deductions | White Coat Investor

How are retained earnings calculated on Form 1120 in ProConnect Tax

Preparing Schedule M-1 or M-3 for a Business - Video | Study.com

Form 1120 Filing Guide: Corporate Tax Return & Schedules Explained